Summary

- YY reported earnings and revenue that easily beat analyst estimates.

- Online music/entertainment continues to be the strongest growth contributor.

- Gross margin expanded 260 basis points over Q4 2012, but is expected to be flat in 2014 on increased investments.

- YY is undervalued compared to its high growth peers and has 50% upside based on the previously established price target of $126.

Q4 highlights

YY's Q4 revenue

increased 136% to $101.1 million, $18.1 million ahead of analyst

estimates. Earnings per share increased 233% to $0.60 and was $0.15

higher than consensus. Most of the strength can be attributed to the

online music/entertainment segment. The segment's revenue increased 49%

sequentially and 217% Y/Y to $55.6 million. Paid users increased 17% Q/Q

to 902,000, while the average revenue per user rose 26% to RMB373. The

company managed to boost growth through series of group entertainment

events and activities, like the popular 2013 Annual Entertainment Awards

ceremony, which drove higher user engagement and spending.Online game revenue rose 6% sequentially and 66% Y/Y to $26.9 million. What is concerning here is that paid users fell by 10,000 over Q3 to 433,000, but the ARPU rose 8% to RMB376. Games operated by YY rose by 15 to 126.

Online advertising fell 3% Q/Q and rose 29% Y/Y to $7.2 million. This sequential fall could be attributed to a rollout of very low-priced products in Q4, which diluted the unit price and increased the number of advertisers for the business. Management indicated that this is not going to be a trend in the future, and this is intended to be a one-time product redesign issue.

Flat margin in 2014

YY's

gross margin rose 250 basis points Q/Q and 360 basis points Y/Y to

51.5%. Management indicated that gross margin will likely be flat in

2014, because the company will invest aggressively this year. RMB1

billion is to be invested in the education segment over the next couple

of years. The company has built a strong foundation for its online

education offering, and has recently launched an education platform

called 100 Education. Education and mobile monetization will be the two

most important segments to look at in the future.Since the music segment is growing the fastest, and its revenue becomes a larger part of the overall revenue, it might impact the gross margin. YY shares approximately 40% of the total music business revenue with singers and channel owners. As this business becomes larger, it brings the gross margin slightly lower. However, we should not be concerned with the short-term impact of investments on YY's profitability, since the company's business model creates significant operating leverage. We should see profit margin improvement in 2015 and beyond, as the education segment scales significantly.

YY is undervalued compared to its peers, price target remains $126

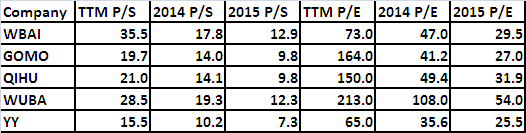

YY trades at a significant discount over its high growth peers. When compared to Qihoo 360 (QIHU), 58.com (WUBA), Sungy Mobile (GOMO) and 500.com (WBAI),

YY is trading at a significant discount. What is in common for all of

the mentioned companies is that they are delivering high earnings and

revenue growth, and are benefiting from strong growth trends in China's

internet population and the increasing usage of smartphones. Every field

these companies are involved with is growing significantly. 58.com is

often called the "Craigslist of China", and has recently released its first earnings report

since going public, which showed strong earnings and revenue growth,

and guided ahead of analyst estimates. Qihoo and 500.com also reported

earnings and revenue ahead of estimates, while Sungy Mobile is yet to

report its first earnings since going public in November 2013. Sungy

Mobile is benefiting from strong mobile growth trends, and has 87

million active users.

Source: Yahoo! Finance

In my previous article on 500.com, I stated that YY remains my top China internet play candidate. While I am maintaining my previous price target of $126, which translates into 50% upside from the current price, YY should also outperform its peers until its valuation comes closer to theirs. This also implies upside of 40% to 50%. If YY and its peers fall from here, YY should be the least affected stock given its lower valuation.

Conclusion

YY

continues to execute its growth strategy very well. The company is on

track to deliver another year of strong growth. Although the gross

margin is expected to be flat in 2014 on increased investments, the

company's operating leverage model will kick into higher gear in 2015,

as the company scales its education segment. YY is currently undervalued

compared to its peers, and has 40% to 50% upside to my price target of

$126.

No comments:

Post a Comment