Summary

- Talk of a biotech bubble is ramping up.

- Some top biotechs have struggled in recent sessions.

- While superficial evidence of a bubble exists, I believe a deeper look at the issue reveals that such talk is premature.

So, let's consider the evidence for and against a dreaded biotech.

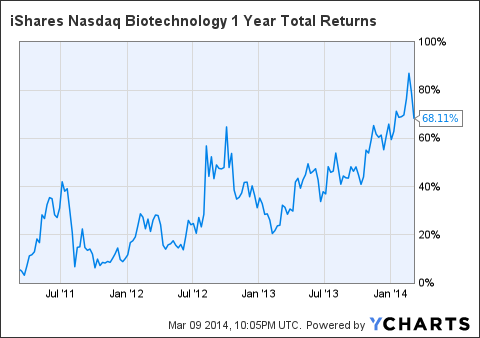

First off, the sector has been on an absolute tear over the past few years, illustrated nicely by the chart below. The iShares Nasdaq Biotechnology (NASDAQ: IBB) is now up 68% within the last two years. Ok, I hate to admit it but that does scream bubble.

IBB 1 Year Total Returns data by YCharts

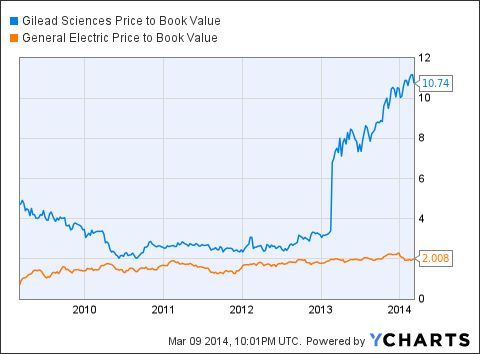

If we compare the price to book value ratios of a bellwether blue chip, General Electric (NYSE: GE), to a top biotech, Gilead Sciences (NASDAQ: GILD),

the picture becomes even bleaker. Essentially, investors are now paying

massive premiums for even top biotechs relative to their intrinsic

value, and these premiums have risen substantially over the past two

years.

GILD Price to Book Value data by YCharts

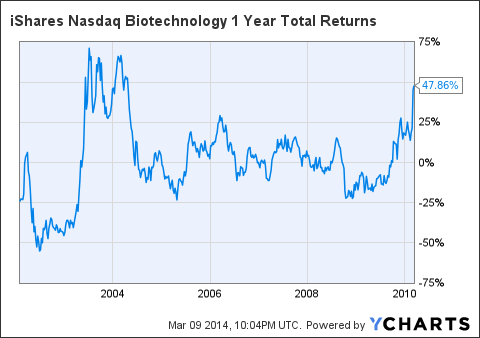

Let's

now consider the biotech sector's long-term performance prior to its

recent bull run. This ten year chart prior to the recent biotech

explosion paints a different picture entirely. From 2001 to 2010, the

sector gained a grand total of 47.8%. The one notable exception is the

period between 2003-2004 that saw a steep rise in this index. Why?

Because the FDA approved 36 new drug applications in the 2003-2004

timeframe.

IBB 1 Year Total Returns data by YCharts

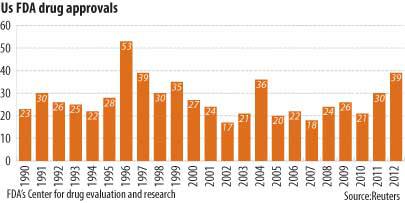

Besides

this single year, however, new drug approvals largely stagnated within

this ten year time period, as shown by the chart below.

A side by side comparison of the sector's performance and number of new drug approvals shows that biotech valuation is intrinsically tied to the amount of innovation that is ultimately translated into a commercial product. Although the FDA only approved 27 new drugs in 2013, it's important to remember that this would have been a strong year in the period from 2001-2010.

I'd also like to point out that the type of innovations coming out of the sector now are a bird of a different feather altogether. In my view, the sector has experienced an nearly unprecedented level of innovation leading to breakthrough drugs, therapies, and medical devices. And ample evidence exists that supports my view.

AbbVie (NYSE: ABBV) and Gilead Sciences, for example, have recently developed functional cures for hepatitis C. Intercept Pharmaceuticals (NASDAQ: ICPT) developed a drug, OCA, that actually reverses liver fibrosis, and looks to be a breakthrough therapy in a host of liver disorders.

I could easily go on, but the broader point is that the dramatic appreciation of the entire biotech sector isn't without merit. As such, I am hesitant to call it a bubble-yet. Yes, companies in the sector are undoubtedly trading at rich premiums, but this does reflect a boon in innovation.

Looking out into the future, I suspect that the sector will begin to level off within the next two years, as revenues catch up to stock prices. But I don't think a major correction is warranted in the true sense of a bursting bubble. Bubbles imply that the asset became irrationally and hence, dangerously, overvalued. If anything, I think the sector is projecting the steady stream of game-changing revenue generators now coming on the market, and the valuation gap isn't unreasonable.

Turning again to Gilead as a prime example, the revenue stream from Sovaldi could set the stock up to trade at a mere 6 to 7 times annual revenue at current levels. And the company has a pipeline chock full of drugs with strong commercial potential. Viewed this way, it would appear that the market has begun to price in some of Gilead's future revenues, but it's a stretch to say it's massively overvalued in the classic bubble scenario.

When bellwethers like Gilead begin to trade at 70 times annual revenues, perhaps then, we should revisit the bubble meme. In the meantime, I think it's a bad idea to get caught up in bubble hysteria. Instead, it's better to keep an eye on the pace of innovation occurring in the sector. After all, that's the true measure of how these stocks will perform over time.

No comments:

Post a Comment