Summary

- Long-biased Hedged Convexity Capture continues to destroy the S&P 500.

- Investors are wasting their time with tired, archaic, complex strategies.

- Brilliant quantitative insights will continue to dominate.

--Admiral Hyman Rickover

Previously, we explored long-biased Hedged Convexity Captures, a strategy which seeks to capture the negative convexity associated with leveraged ETPs. The idea behind Hedged Convexity Capture, as I outline in my book, is to capture the potential returns from shorting leveraged inverse equity ETPs with lower drawdowns and far higher Sharpe ratios than by just shorting them outright. The strategy seeks to accomplish this by shorting leveraged inverse equity ETPs like TZA (TZA) and pairing that short with a short position in TMV (TMV), an inverse leveraged long bond ETP.

Not only does shorting TMV often provide a hedge for the equity portion of the strategy, but TMV itself suffers from negative convexity, further increasing the effectiveness of the long bond hedge.

As before, we will use some simple rules, but this time, will focus on long-biased Hedged Convexity Capture using the 3X inverse small cap ETP, which suffers from excellent negative convexity. We shall efficiently capture this negative convexity in a hedged manner with the following rules:

I. Short TZA with 50% of the dollar value of the portfolio

II. Short TMV with 50% of the dollar value of the portfolio.

III. Rebalance weekly to maintain the 50%/50% dollar value weighting between the two instruments.

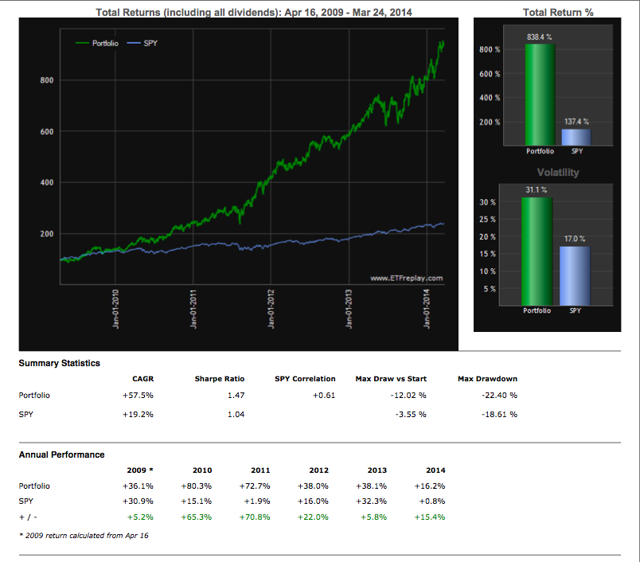

Here are some graphs of the results:

(click to enlarge)

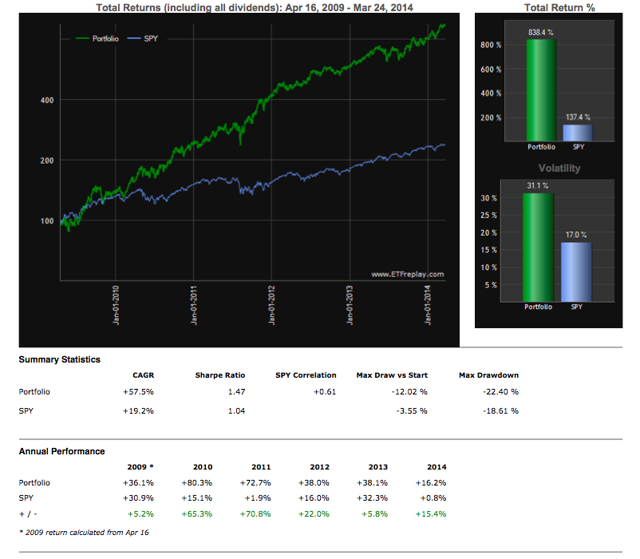

The graph above has a linear scale. The log scale graph is below:

(click to enlarge)

What's fascinating about this strategy is that it actually accomplishes what other strategies purport to. It outperforms the S&P 500's SPY (SPY) ETF by 38 percentage points per year, it consistently outperforms the S&P 500 in every calendar year since inception of the strategy, and it does so with a smoother ride. I have absolutely no idea why people would be interested in individual stock ideas, or complex strategies which use dozens of stocks, when they can use a strategy which can be executed easily with two instruments rebalanced weekly. The fascination of the public with complication, rather than with mathematical elegance, continues to amaze me.

Clearly, this strategy massively outperforms the S&P 500, with a far superior CAGR/Max Drawdown ratio, also known as the MAR ratio. The MAR ratio is the ultimate measure of a strategy, trader, or investor's performance. Moreover, the ride for an investor in this strategy is not very bumpy, with a Sharpe ratio which far exceeds that of the S&P 500.

I am always fascinated with the illogical obsession that the public has with investment bestsellers, the best of which present tired investment strategies which only outperform popular indices by 2 to 5 percentage points per year. These books are usually mechanized, warmed over versions of Benjamin Graham's original value-based investment strategies, which were totally revolutionary decades ago. And of course, Graham was a total genius, and many of his strategies continue to perform extremely well today. I just have a real problem with people taking leftovers from the master, putting them in the microwave to reheat them 70 years later, then calling it original cuisine, rather than blatant copying with very few new ideas.

The goal of my firm's intellectual property library of quant strategies and of our continuing R&D is to do wildly new things which no one has seen before. But no individual strategy is the product. The product is innovation itself. And I think we have accomplished that on many occasions, with the public version of long-biased Hedged Convexity Capture, even stripped of its advanced bells and whistles, outperforming the S&P 500 by 38 percentage points per year.

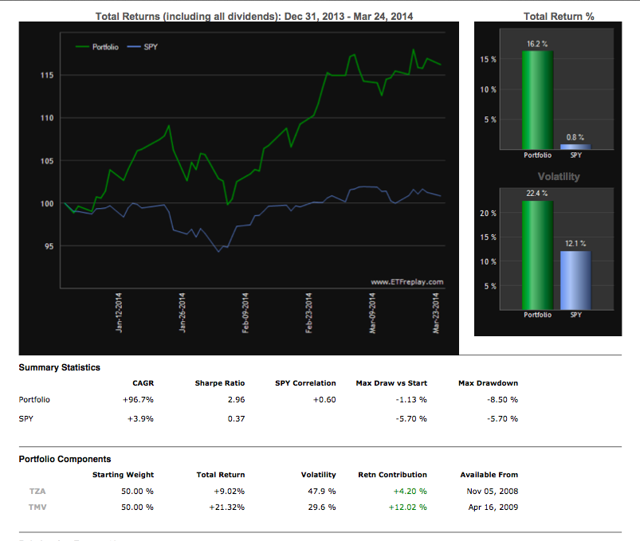

This does not mean that this massive outperformance will continue, but it does mean that the strategy is well worth further exploration. Interestingly enough though, long-biased Hedged Convexity Capture continues to dominate the SPY YTD by 15 percentage points, which is outstanding in a choppy market, and blows away the critics who thought the strategy could not withstand equity headwinds.

(click to enlarge)

My personal view is that the strategy could underperform during strong bull markets, but will outperform during choppy and bear markets for equities. Of special interest is the high Sharpe, combined with a MAR ratio that far exceeds that of the SPY ETP over the same time period with only moderate correlations to the S&P 500.

However, even though the strategy tests well, I never rely on theory alone. The advanced non-public version of this strategy uses a systematic switch to enter and to exit the strategy to further reduce risk.

I believe the strategy's major risk, since it uses shorting, is a discontinuous drop in markets which causes the TZA leg of the trade to skyrocket far more than the TMV could drop.

As I often say, no strategy is even close to perfect. There are only strategies which are preferable to all other possible alternatives. We have created an advanced non-public version of the strategy for clients which does not use shorting. I think the public version presented here has the ability to stimulate thinking on the part of investors by clearly illustrating that even seemingly simple strategies using powerful mathematical principles can dramatically outperform strategies presented in popular bestsellers, while using fewer instruments with less hassle to implement.

Investors are constantly bombarded with intuitive strategies. And intuitive strategies may be excellent marketing vehicles, but they are often far worse performers than non-intuitive strategies. Strategies which rely upon an understanding of pure mathematics have a higher probability of sustained outperformance, because most people are not wired to feel emotionally comfortable with mathematical strategies.

It is this emotional discomfort which not only hinders the popular adoptions of such strategies, but also creates the potential for sustained outperformance for those unique investors who do appreciate their logic.

The bottom line for investors is that technology is evolving quickly. Professional traders like myself have invested heavily in cutting-edge R&Dwww.amazon.com/Youre-Welcome-Planet-Earth-Powerful-ebook/dp/B00DBT66MI/ref=la_B00DC7EPJK_1_1. We have objectively proven that the results of this R&D far exceed the performance of everything else publicly available up to this point. Therefore, the public should stop being impressed going forward with any method which does not have the ability to outperform equity indices by huge margins.

No comments:

Post a Comment