Wheat ETF Surging on Ukraine Issues, Weather Outlook

WEAT DBA CORNAs a result, the commodity plunged as much as 30% last year. However, the situation took a sharp turn this year mainly on supply concerns raised by the Russia-Ukraine geopolitical crisis, and the reduced U.S. crop outlook (read: 4 Agricultural Commodity ETFs Soaring in 2014).

Ukrainian Crisis Boosted Wheat Prices: While the global economy is presently jeopardized by Russia’s annexation attempt of Crimea (which was part of Ukraine) and the nation’s face-off with the Western world, some commodities received a much-needed boost from this turmoil and wheat is one of them.

Ukraine is one of the largest exporters of wheat selling a large portion of its grain to Egypt and to other Middle Eastern countries and Africa. Traders believed that the Russia-Ukrainian crisis would disrupt Ukraine’s export activity, helping to push wheat prices to multi-month high levels at the start of this month and will likely continue the price surge in the days ahead.

Negative U.S. Production Outlook: Speculation of cold and dry weather in the U.S. pushed the wheat futures to a 10-month high as such weather would curb production in the U.S. southern Great Plains. As per Bloomberg, nearly two-thirds of this staple growing region in the Southern Plains will likely remain dry for the rest of March (see all the Agricultural ETFs here).

Almost the entire western half of Kansas, the largest U.S. wheat producing zone, is under severe to extreme drought conditions, according to the U.S. Drought Monitor. The near-term weather forecast does not give any favorable cues for production. Due to this, wheat prices have also been soaring, much like their counterparts in the corn market.

Market Impact

All these above-said issues led the staple to skyrocket 30% since closing at a 42-month low of $5.515 on January 29, aided by shipping delays in Canada and Argentina and the Ukrainian unrest.

Investors can easily play this trend via Teucrium Wheat ETF (WEAT), a commodity product from the issuer Teucrium. This fund invests in wheat futures that are traded on the CBOT but does it in a way that looks to lower contango issues (see more in the Zacks ETF Center).

WEAT looks to reflect the daily changes of a weighted average of the closing prices for 3 futures contracts for wheat that are traded on the CBOT, specifically: (1) the second-to-expire contract, weighted 35%, (2) the third-to-expire contract, weighted 30%, and (3) the contract expiring in the December following the expiration month of the third-to-expire contract, weighted 35%.

However, the fund is a bit pricey as evidenced by its 2.23% expense ratio. The fund has been on a run over the last three months though, as it has added more than 12% in the time frame.

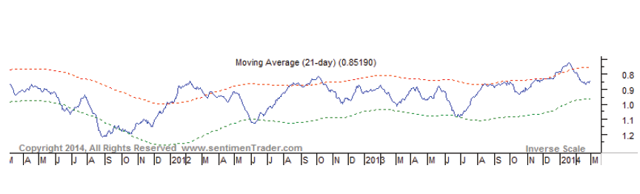

Also, WEAT is currently trading in the middle of its 52-week range. Its short-term moving average is higher than the long-term average. WEAT is also trading higher than the parabolic SAR indicator. This suggests continued bullishness for this ETF. The relative strength index for WEAT is presently below 65, indicating that the fund has still time to move higher before it reaches overbought territory.

Bottom Line

While the situation is highly volatile on the Ukraine front, and can prove a boon or bane at any moment for wheat, the weather report back home will surely act as a price driver in the months ahead. There is just one glitch, with the Fed steadily withdrawing its monetary support, the dollar will likely gain strength in the course of 2014 marring the appeal for commodity investing (also see 3 Commodity ETFs to Watch in 2014).

With that being said, we would like to notify that all the technical indicators are in favor of the fund at present. After a choppy 2013, the fund started this year with an undervalued status. So, it is a fifty-fifty situation for the fund. In any case, WEAT has a Zacks ETF Rank of #3 (Hold) suggesting that it may be a rocky road ahead for this commodity fund.