This article was first released only to PRO subscribers. Learn More

Discovering the next breakout biotech company can be a monumental task for investors. Those who follow the industry have witnessed a number of biotech stocks posting incredible gains. Intercept Pharmaceuticals (ICPT) is probably one that will be talked about for years to come. The company's lead product candidate, obeticholic acid (OCA), is a bile acid analog and first-in-class agonist of the farnesoid X receptor (FXR). On January 9th Intercept announced that the FLINT trial of obeticholic acid (OCA) for the treatment of nonalcoholic steatohepatitis (NASH) had been stopped early based on a planned interim analysis showing that the primary endpoint of the trial had been met. The news was followed by an explosion in share price of over 500%. Investors were left scratching their heads dumbfounded, trying to figure out what was so unique about this company that could cause such a surge in share price. Following the news the investment community put a spotlight on pipeline therapies to treat NASH in attempt to find any other company with a product in development. As expected twitter and other social media message boards blew up with claims from investors touting they had the next ICPT.

After doing some research I came to the realization that Intercept's story was somewhat of anomaly in the biotech world. After all it's not unheard for biotech's to surprise investors with positive data from clinical trials. But, rarely do we see such a dramatic response in price movement. Intercept is unique because it had the perfect setup in place to make such a sensational move. Many factors contributed to the now infamous run up but the three main factors highlighted below are what helped light the fire. After gaining some insight on Intercepts amazing story I set out to see if there were other hidden gems with similar attributes waiting to be discovered. My research uncovered a great deal of biotech companies with pieces to the puzzle but finding one with similar potential was quite a challenge. To my delight I stumbled upon a company that fit the bill. This article will provide an in depth analysis on why I believe Ocera Therapeutics (OCRX) has the potential to realize massive gains for investors in 2014 and beyond.

Disease state

The first contributing factor is uncovering a disease state with a strong unmet need and limited available therapy options for patients. NASH is fascinating because not only are there no approved medications to treat patients, but there is also a huge patient population with estimates around 6 million people in the U.S. alone.

Under the radar

If a poll was taken prior to Intercepts breakout it's likely that 99% of investors had never heard of NASH or Intercept pharmaceuticals. OCA was initially being developed for the second line treatment of primary biliary cirrhosis ((PBC)) in patients with an inadequate response to, or who are unable to tolerate, ursodiol, the only approved therapy for this indication. In fact it's difficult to find any mention of the NASH indication prior to Jan 9th. Despite a successful IPO launch in October of 2012 Intercept was all but forgotten by investors. The day of the IPO Intercept's shares closed up 29% with 813K shares traded. The following day 45K shares were traded and volume fluctuated for months, at times as low as 1K shares traded. Besides the usual short articles that sprout up when a stock price shows some growth, very few articles were written on the company. Social media was non existent providing further evidence that Intercept was off the radar of the investment community.

Low Float

Stocks with low floats can have a huge impact on stock price especially when news breaks. It's simply the economics of supply and demand. Good or bad, when news breaks stocks with low floats will make dramatic swings. Intercept had a float of approximately 9 million shares and when the NASH data was announced shareholders who understood the true value of the company weren't selling, thus resulting in the now infamous run up.

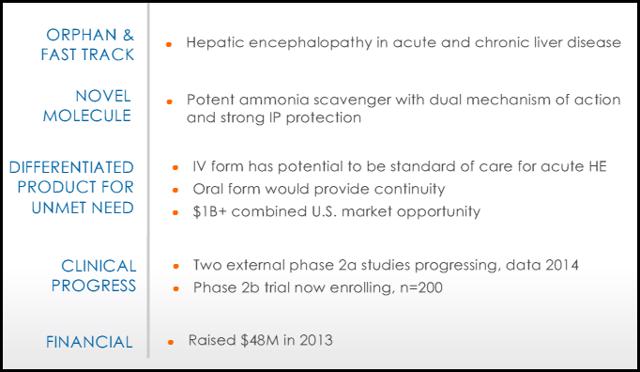

Ocera Therapeutics is a company focused on developing therapies for acute and chronic liver disease. Ocera's lead product, OCR-002 is for the treatment of acute and chronic HE. The product has already received orphan drug designation((ODD)) and fast track status in the U.S. for both HE and acute liver failure. In Europe the drug has ODD for acute liver failure and the company plans to pursue ODD for HE in 2014.

All slides except where noted are taken from the latest corporate presentation by Ocera.

Brief history

Up until July of 2013, Ocera was a private company quietly focusing on products to treat a variety of GI diseases. On July 15, 2013, Ocera wentpublic through a reverse merger with Tranzyme Pharma Inc. Ocera CEO Linda Grais opted for the reverse merger instead of an IPO because she felt the process would be quicker and less costly. The marriage of the two companies was perfect, Tranzyme was a publicly traded company coming off of a failed phase 3 trial of their lead product Ulimorelin. The disappointing results left them with a strong clinical development team in search of a new product to develop. Ocera had the product but lacked a clinical team necessary to fully develop OCR-002. The resulting merger combined the two companies and traded under the ticker OCRX on the Nasdaq Global market. The initial stock price opened up at 6.23 and quickly shot up to 17.20 before settling in the 8-10 range. The stage was set for Ocera to demonstrate why their lead product could help thousands of patients suffering from hepatic encephalopathy.

Hepatic Encephalopathy

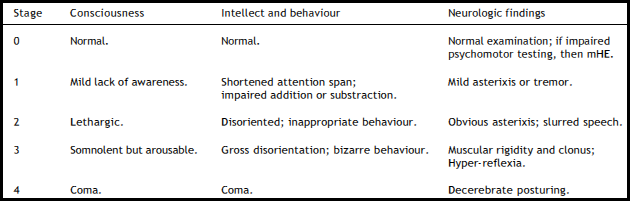

The Canadian Liver Foundation defines Hepatic Encephalopathy(HE) as a disorder of mental activity, neuromuscular function and consciousness that occurs as a result of either chronic or acute liver failure. The disease is brought on when the liver is damaged, typically from cirrhosis, acute liver failure, or from portosystemic shunting, even in the absence of intrinsic liver disease. The liver is responsible for cleansing and removing toxins from the blood. When the liver is damaged toxins begin to build up in the blood and travel throughout the body until they reach the brain. As a result, the blood is not detoxified and blood levels of toxic substances rise. Persistently elevated neurotoxin levels damage brain cells and patients begin to develop HE. In patients with progressive HE, there is a gradual decrease in level of consciousness, intellectual capacity, and logical behavior, along with the development of specific neurologic deficits. The premise of most pathophysiologic theories involves the accumulation of ammonia in the central nervous system, producing alterations of neurotransmission that affect consciousness and behavior. These ammonia toxicity theories have been supported by studies demonstrating increased ammonia levels in patients with both fulminant hepatic failure and chronic liver disease. HE can be classified as either 'overt 'or 'minimal'. Overt HE (OHE) is a syndrome of neurological and neuropsychiatric abnormalities that can be detected with bedside clinical tests. By contrast, patients with Minimal HE (MHE) present with normal mental and neurological status upon clinical examination but specific psychometric tests yield abnormal results. The most common classification system for HE disorders is the West Haven Criteria.

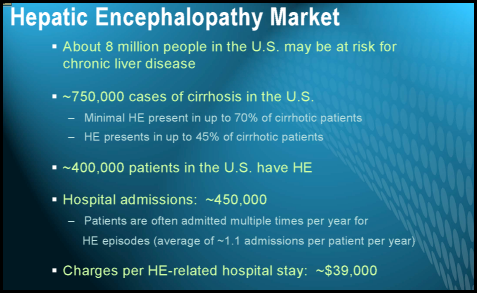

In the United States, research shows approximately 8 million people are at risk for chronic liver disease. Of those, there are more than 750,000 cases of cirrhosis with up to 45% developing HE. The more advanced a patient's liver disease, the more likely the patient will experience HE, and patients can experience irreversible damage after just one event. Prognosis is poor, with a 58% mortality rate at 1 year, and a 77% mortality rate at 3 years. Although prevalence estimates vary, 20% to 80% of patients are thought to have MHE and 30% to 45% have experienced episodes of overt HE. The majority of patients with cirrhosis will develop HE at some point during the course of the disease.

Current treatment options

Ammonia is produced when protein is digested. A healthy liver clears ammonia from the blood on a daily basis. However patients with HE are advised to eat a low protein diet to reduce any excess ammonia that may already exist.

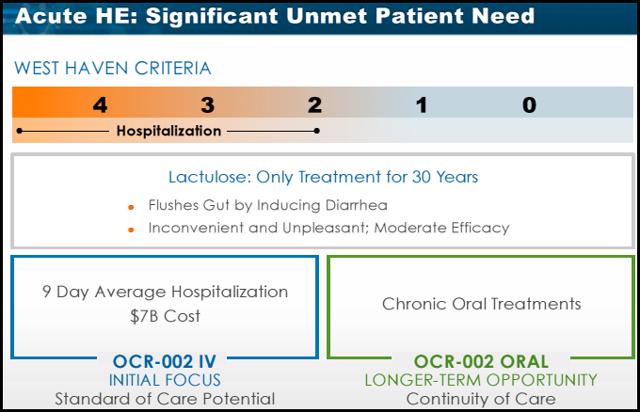

Lactulose

Lactulose is indicated for both chronic and acute HE and has been the standard of care for 30 years. Lactulose, a synthetic disaccharide, works by drawing water from your body into your colon, which softens stools and causes you to have more bowel movements. This helps lessen the absorption of toxins in your intestines and flush them out of your system. It also reduces the amount of ammonia in your blood by drawing the ammonia into the colon where it's removed from the body via bowel movements. The main side effects are diarrhea, nausea, gas, abdominal discomfort, and dehydration. Studies on Lactulose are mixed with some finding no difference between Lactulose and Placebo when treating HE. The efficacy is controversial and a recent meta-analysis demonstrated that Lactulose may actually have only a minimal effect on treating HE. The lack of efficacy is further demonstrated by an average hospital stay of 9 days for HE patients in this acute setting. The main reason patients fail on Lactulose is because of the serious GI side effects. The difficult dosing schedule (dosed until the patient has 2-3 bowl movements a day) creates a problem with adherence for both the patient and caregiver. According to the Bajaj study 75% of these patients had another HE event within 9 months. Despite theses concerns, Lactulose remains the standard of care in treating HE.

Antibiotics

Xifaxin (Rifaximin)

The U.S. Food and Drug Administration ((FDA)), in March 2010, approved the use of rifaximin for reduction in the risk of the recurrence of overt hepatic encephalopathy in patients with advanced liver disease. Xifaxin is a minimally absorbed (less than 0.4%) antibiotic with broad spectrum activity against gram-positive and gram-negative aerobic and anaerobic bacteria. In a large, multicenter trial, patients on Rifaximin and Lactulose maintained remission from HE better than Lactulose alone and also reduced the number of hospitalizations involving HE. Although Rifaximin is more tolerable and efficacious, the increased cost and concern over long term use with antibiotics are a few of the reasons why Lactulose is still preferred as initial therapy. In clinical practice, Lactulose is typically used initially and Rifaximin added if needed. The pivotal clinical trial which supports the license in the US was published in the New England Journal of Medicine. It showed that Rifaximin significantly reduced the risk of an episode of hepatic encephalopathy, as compared with placebo, over a 6-month period (hazard ratio with Rifaximin, 0.42; 95% confidence interval 0.28 to 0.64; P<0.001). A breakthrough episode of hepatic encephalopathy occurred in 22.1% of patients in the Rifaximin group, as compared with 45.9% of patients in the placebo group. A total of 13.6% of the patients in the Rifaximin group had a hospitalization involving hepatic encephalopathy, as compared with 22.6% of patients in the placebo group, for a hazard ratio of 0.50 (95% CI, 0.29 to 0.87; P=0.01).

Neomycin

Neomycin was one of the first antibiotics to be investigated as a potential treatment for HE. The antibiotic works by inhibiting mucosal glutaminase in the intestine, which reduces ammonia production in the gut. The main adverse effects of Neomycin sulfate administration include ototoxic and nephrotoxic effects and intestinal malabsorption. Neomycin is rarely used today since Rifamaxin has proven to be a safer and more efficacious for the treatment of HE.

Ocera's unique therapy to address unmet needs

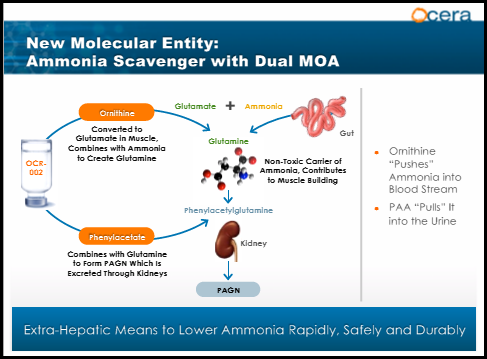

OCR-002 (ornithine phenylacetate) is an ammonia scavenger designed to rapidly lower abnormally elevated systemic ammonia level (hyperammonemia) and treat hepatic encephalopathy in patients with liver cirrhosis and acute liver failure. OCR-002 uses a dual mechanism of action with ornithine pushing excess ammonia into the blood stream and phenylacetate pulling it into the kidneys where it's excreted. The product has received orphan drug designation and fast track status through the FDA. Pre-clinical studies demonstrated that OCR-002 significantly reduces arterial ammonia and is safe and well tolerated. "With OCR-002, for the first time, we are able to reduce circulating ammonia levels in a consistent and controlled way which gives us the ability to treat complications of liver disease as well as the ability to better understand the pathophysiology of liver disease and its complications," stated Professor Rajiv Jalan M.D. at the Institute of Hepatology, UCL. There are currently 3 studies ongoing in acute liver failure, hyperammonemia in upper GI bleed, and acute HE.

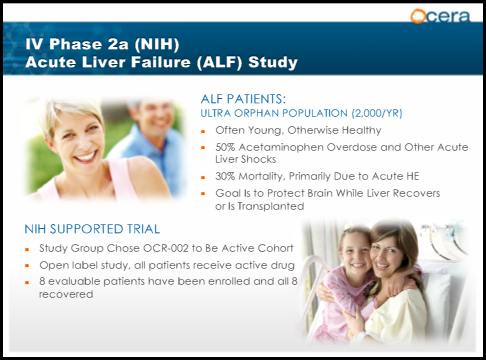

Acute Liver Failure(ALF)

Acute liver failure is an uncommon condition in which the rapid deterioration of liver function results in coagulopathy, usually with an international normalized ratio (INR) of greater than 1.5, and alteration in the mental status (encephalopathy) of a previously healthy individual. Acute liver failure often affects young people and carries a very high mortality. For liver failure that is the result of long-term deterioration, the initial treatment goal may be to save whatever part of the liver is still functioning. If this is not possible, then a liver transplant is required. ALF results in a 30% mortality rate due to Acute HE. The goal of treatment is to protect the brain while the liver recovers or is transplanted. Time is a critical factor for patients with ALF and Lactulose is currently the standard of care. OCR-002 is currently in a study titled STOP-ALF a Phase 2a multi-center, open-label study that will enroll 24 participants with severe acute liver injury or acute liver failure. The primary endpoint will be safety and tolerability. Secondary endpoints include measurement of OCR-002 plasma concentration, change in venous ammonia and neurological function. The investigator-sponsored study, is being conducted by The Acute Liver Failure Study Group, a National Institutes of Health-funded consortium led by UT Southwestern Medical Center. "When a patient presents with acute liver failure, physicians have no medicines available that can directly lower circulating levels of ammonia, which drive hepatic encephalopathy and can lead to coma and death," stated William M. Lee, M.D., Lead Investigator, and Professor, Internal Medicine, UT Southwestern. Preliminary data demonstrated that the first 8 patients enrolled all had a full recovery. The study is expected to be completed in the 2nd half of 2014.

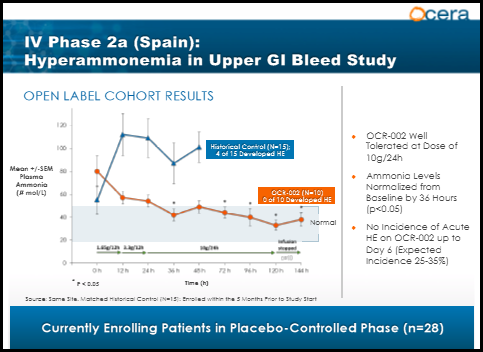

Upper GI Bleed(UGIB)

Gastrointestinal bleeding: The presence of blood in the upper gastrointestinal tract results in increased ammonia and nitrogen absorption from the gut. Bleeding may predispose to kidney hypoperfusion and impaired renal function. The treatment goal is to quickly lower ammonia levels in an effort to prevent HE. UGIB is a complication of liver cirrhosis, and often leads to acute HE. A phase 2A study sponsored by the Hospital Universitari Vall d'Hebron Research Institute is currently underway evaluating OCR-002 in a double-blind, placebo-controlled study and will measure as the primary endpoint ammonia plasma concentration and improvement in HE as a secondary endpoint. Dr. Juan Cordoba of Hospital Universitari Vall d'Hebron and the lead investigator of the study stated "Cirrhosis patients that present with acute upper gastrointestinal bleeding have a 30% chance of developing hepatic encephalopathy and require intensive care. A medicine that can quickly remove the toxic ammonia may help prevent or reverse this life-threatening condition, minimize the need for intensive care and shorten hospitalization." Preliminary data was released in May of 2012. The graph below shows the first 10 patients(orange line) receiving OCR-002 presented similarly with elevated ammonia levels, but levels quickly dropped within 36 hours and remained in the normal range, even after therapy stopped at 5 days. The blue line represents historical patients from the same site 5 months prior to the trial start. Patients presented with elevated ammonia levels and despite receiving the standard of care(Lactulose), the ammonia levels continued to spike resulting in 4 out of the 15 patients developing HE. The study is estimated to complete enrollment in March 2014 with top line data in May or June.

Acute HE

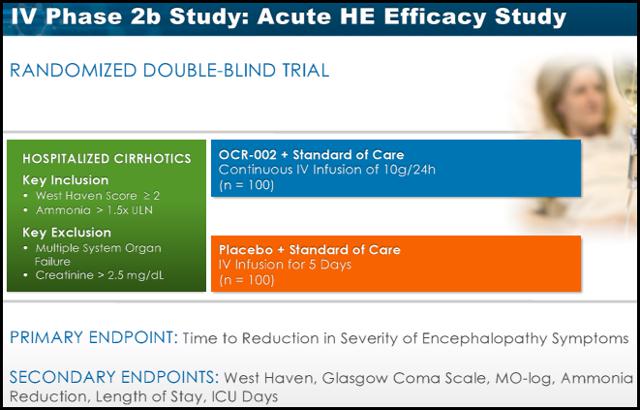

On Jan 8th Ocera announced enrollment of the first patient in its multi-center Phase 2b study, titled "STOP-HE". This study will evaluate the efficacy, safety and pharmacokinetics of OCR-002, or ornithine phenylacetate, in hospitalized patients with liver cirrhosis and an acute episode of hepatic encephalopathy. The study will enroll 200 patients experiencing an acute episode of HE and is expected to be completed by November 2014.

Socio-Economic burden

Research from Ocera shows HE hospitalizations average about 9 days costing roughly $7 billion annually in the U.S. A lack of treatment options is the main contributor to prolonged hospital stays. Experts in the HE arena have been anxiously waiting for a treatment to combat acute HE in the hospital setting to help reduce extended lengths of stay. Family members and caregivers of patients with HE often absorb the challenges of this medical condition. For instance, since screening for mental changes in early HE can be somewhat difficult, it is often family members who alert physicians to changes in the patient's mental state. Despite this, data on the socioeconomic and emotional burden of HE on the family are scarce. Bajaj and colleagues(sited above) recently evaluated the emotional and financial burden of cirrhosis on patients and informal caregivers. In this cross-sectional study, 104 cirrhotic patients underwent cognitive battery, sociodemographic, and financial questionnaires. The Bajaj study demonstrated that cirrhosis places a significant financial, socioeconomic, and personal burden on not only patients, but their caregivers as well. Cirrhosis-related medical expenses affected the family and resulted in many financial sacrifices compared to the 3 previous years. The most common sacrifices included inability to save money (56%) and debt (46%). Caregivers reported suffering from various degrees of depression(28%) and anxiety (29%), which the authors attribute to the scant social support provided to these individuals. Similar to what is seen with Alzheimer's disease, the burden of severity was found to be significantly higher for spouses compared to other caregivers. Within the PCB, spouses had significantly higher disruptions of schedule (P = .05), personal health (P = .002), and feelings of entrapment (P = .004).28. With a lack of treatment options providing rapid efficacy and safety, Patients and caregivers continue to suffer every day.

Commercial activities

In December 2009, Tranzyme(pre merger) entered into a two -year collaboration agreement with Bristol-Myers Squibb Company to discover, develop and commercialize novel macrocyclic compounds. On January 4, 2013, Tranzyme announced the successful completion of its chemistry-based drug discovery collaboration with BMS. As a result of the joint research efforts, the Company transferred compounds to BMS for further development across multiple drug targets. Under the terms of the agreement, BMS is solely responsible for preclinical and clinical development of all products arising from the collaboration and for their commercialization globally. In connection with the agreement, the Company may receive up to approximately $80.0 million in additional development milestone payments, and $30.0 million in sales milestone payments, for each target program if development and regulatory milestones, or commercial milestones, respectively, are achieved. In addition, the Company would receive graduated single-digit percentage royalties and sales milestone payments on annual net sales of commercial products. During the third quarter review of the Bristol-Myers Squibb collaboration agreement, Ocera determined that BMS will terminate its efforts on the development of one of two macrocyclic compounds under development pursuant to the Company's on-going collaboration agreement.

Recently Ocera entered into a Technology Transfer and License Agreement with the Roche Group, including the Research and Early Development arms of both Genentech and Roche, for rights to its Macrocyclic Template Chemistry(MATCH™) discovery platform. Under the terms of the agreement, Ocera will transfer ownership of equipment and materials related to the use of the MATCH™ technology, and grant a license to Genentech and Roche under Ocera's related intellectual property rights. The Roche Group will make a one-time payment to Ocera of $4 million.

Ocera has an additional product called Zysa™ (AST-120) a spherical carbon adsorbent, for the treatment of irritable bowel syndrome. They licensed the compound from Kureha Corporation in 2005. Zysa is marketed in Asia asKremezin to treat chronic kidney disease. In March 2012, Private Ocera received CE Mark for the sale of AST-120 as a medical device for the treatment of diarrhea predominant irritable bowel syndrome (d-IBS) in the European Market. The company is currently evaluating strategic options for the commercialization of this product.

Management

Effective management is a critical factor for developmental biotech's like Ocera. Ocera has one the most impressive management teams in the biotech industry. The following profiles are taking off the Ocera website.

Linda S Grais M.D. has served as a member of the Board of Directors of Ocera Therapeutics, Inc. since January 2008 and as President and Chief Executive Officer of Ocera Therapeutics, Inc. since June 2012. Prior to her employment by Ocera, Dr. Grais served as a Managing Member at InterWest Partners, a venture capital firm from May 2005 until February 2011. From July 1998 to July 2003, Dr. Grais was a founder and executive vice president of SGX Pharmaceuticals Inc., a drug discovery company focusing on new treatments for cancer. Prior to that, she was a corporate attorney at Wilson Sonsini Goodrich & Rosati, where she practiced in such areas as venture financings, public offerings and strategic partnerships. Before practicing law, Dr. Grais worked as an assistant clinical professor of Internal Medicine and Critical Care at the University of California, San Francisco. Dr. Grais received a B.A. from Yale University, magna cum laude, and Phi Beta Kappa, an M.D. from Yale Medical School and a J.D. from Stanford Law School. She currently serves on the Board of Directors of Arca Biopharma, Inc.

Ms. Hilleman has served as Chief Financial Officer since September 2013. From 2012-2013, Ms. Hilleman provided independent financial and strategic consulting for biotech and cleantech companies. From 2008 to 2012, she served as CFO of Amyris, Inc. a multi-national, renewable products company based in California and Brazil. Prior to Amyris, Ms. Hilleman served as CFO of Symyx Technologies, a public company selling instruments, software and research services to pharmaceutical and chemical companies, and led the finance function at two public biotechnology companies, Geron Corporation and Cytel Corporation. Ms. Hilleman is also a member of the board of directors and chair of the audit committee of Xenoport Ms. Hilleman holds an A.B. from Brown University and an M.B.A. from the Wharton Graduate School of Business.

Dr. Rousseau has served as Chief Medical and Development Officer and as a member of the Board of Directors of Ocera Therapeutics, Inc. since July 2013. He joined Ocera (formerly Tranzyme) as Chief Medical Officer in October 2011. From 2003 to 2010, he worked at Gilead Sciences, Inc. where he had most recently served as Therapeutic Area Head, Hepatic Diseases, and initially as Vice President, Clinical Development. During this time, when he also was head of Gilead's Durham, North Carolina facility, Dr. Rousseau oversaw the clinical development for several drugs which ultimately received global marketing approval. From 1997 to 2002, Dr. Rousseau was Chief Medical Officer of Triangle Pharmaceuticals until its acquisition by Gilead in 2003. He began his pharmaceutical industry career in 1993 at Wellcome Lab, followed by two years with Glaxo Wellcome from 1995-1997 serving as Medical Advisor. Dr. Rousseau holds a Doctorate of Medicine and a Degree of Epidemiology and Nosocomial Infections from the University of Paris 7, Paris, France. He also holds a Degree of Statistics from the University of Paris 6, Paris, France.

Market Potential

The market for HE is large and growing rapidly. It's estimated that in the US alone approximately 400k-500k people have HE. Data shows there are 450k hospital admissions each year for acute HE. The combined market for chronic and acute HE is estimated at 1.5 billion per year.

Finances

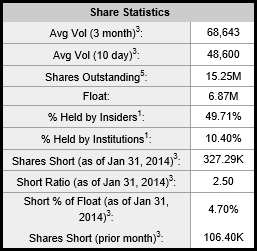

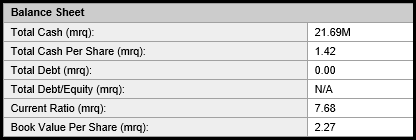

Ocera has strong inside and institutional ownership and as of Q3 2013 has over 21 million in cash. The deal with Roche will add another 4 million to their cash position and CEO Linda Grais has stated the company has enough cash to get through 2014. The following charts are taken from Yahoofinance.

ICPT rationale

Disease state

Hepatic Encephalopathy has very few treatments options. There are no IV therapies available to address the critical needs of patients in the hospital setting. OCR-002 if approved would most certainly become the standard of care allowing a significantly reduced hospital stay and potentially saving millions of dollars for hospitals. The oral formulation is a perfect fit for these patients who require continued therapy after discharge (as data shows more than half of these patients are left untreated due to lack of adherence to present therapy). HE has a market potential of over 1.5 billion and growing.

Under the radar

Ocera like ICPT is completely off the radar of investors. OCR-002 has shown 100% recovery in the preliminary data from two phase 2a studies. For investors questioning why this exceptional data has gone unnoticed, the answer is simple. Both of the studies released data prior to Ocera going public so the news was virtually ignored by the investment community. Social media is another clear sign that Ocera is under the radar. The popular investment site Stocktwits has only 14 people who currently track OCRX.

Low Float

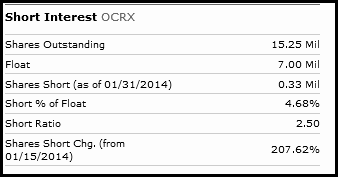

Ocera has approximately 15 million shares outstanding with a float of just under 7 million. The stock is thinly traded with a current 10 day avg volume of just 49k shares traded daily. Like ICPT, Ocera will make a drastic move on news.

Summary of Key Investments Points

Preliminary data

Interim data from both the phase 2a studies was released when Ocera was still a private company. The data was phenomenal with both studies reporting 100% recovery of symptoms. Had Ocera been public at the time of the data release the stock price would have already made a substantial move.

2014 Catalysts

Phase 2a GI Bleed- results expected late Q2

Phase 2a ALF- results expected in late Q4

Phase 2b AHE- results expected late Q4-Q1

ODD for HE in Europe- 2nd half of 2014

HE Market

Currently there are very few treatments to address this growing disease. OCR-002 if approved would be the only IV formulation available to treat patients in the hospital. KOL's agree that OCR-002 will likely become the standard of care in the hospital setting. The oral formulation of OCR-002 would be a logical choice for patients as they are discharged from the hospital. With a market potential over 1.5 billion and growing, having a therapy considered to be the future standard of care gives Ocera a strong advantage.

ICPT rationale

As mentioned above Ocera has the same attributes that saw ICPT breakout on positive news. The only difference is Ocera has already given investors a sneak peak into upcoming data from their 2 phase 2a studies potentially limiting some risk.

Valuation

Ocera estimates the market potential for treating patients in the hospital to be $500-$700 million per year in the U.S. OCR-002 would be the only IV treatment available making it the sole standard of care. At the proposed price of $1300 per day, modeling(see corporate presentation link above) demonstrated 80% of formularies would approve OCR-002. Hospitals are hemorrhaging money due to extended length of stays. With an average hospital stay of 9 days, OCR-002 would be a logical choice assuming further studies continue to show patient recovery within 36 hours. Additionally, physicians surveyed on a scale of 1(no interest in product) to 7(willing to advocate strongly) scored a 6.1. The top 3 reasons physicians gave were shorter hospital stay, quick response rate, and time to response. With Lactulose currently the only approved treatment for HE in the acute setting OCR-002 will undoubtedly become the sole standard of care. Ocera estimates cost of treatment per day at $1300. The market estimates for hospital admissions range from 150k to 450k. Taking a conservative estimate and assuming 50% of patients admitted to the hospital will receive the IV formulation of OCR-002, peak sales would be approximately $780 million. As mentioned above Ocera is also developing an oral formulation for patients as they are discharged from the hospital. The pill will allow patients to continue therapy upon discharge. Xifaxin sales are estimated to be $650 million for 2013 and the product has seen rapid growth since launching in 2010. It's difficult to estimate revenue potential for oral OCR-002 using Xifaxin revenues because albeit a fraction of total revenues, Xifaxin is also indicated for Travelers' diahrrea and used off label to treat IBS. The yearly cost of Xifaxin is approximately $6000 per patient. The other challenge in estimating oral OCR-002 sales is estimating pricing because it's likely to be different from the IV formulation. Conservatively I will estimate $3000 per patient(half of Xifaxin) and assume two thirds of patients will remain on OCR-002 after leaving the hospital resulting in $600 million peak sales. It's also important to remember that OCR-002 will likely be used in combination with either Lactulose or Xifaxin for continued therapy thus limiting any major competitive threats. I make this assumption based on the fact that the majority of patients on Xifaxin are also taking Lactulose. The severity of the disease warrants using every tool available to prevent the devastating effects of HE. Taking the combined peak sales of well over $1 billion its clear that Ocera's current stock price of $15 and market cap of 230 million are significantly undervalued. These projections don't include sales outside of the U.S. which would dramatically increase the value of the company.

The next major catalyst will be data from the phase 2a Upper GI study expected around mid year. Investors also get the added bonus of a sneak peak at preliminary data from both phase 2a studies demonstrating that all patients on OCR-002 recovered and did not develop HE. If you missed out on the amazing gains seen by ICPT, investing in Ocera presents a similar opportunity to realize incredible profits. Of course with any biotech investment there is considerable risks and investors should perform their own due diligence before investing in any stock. There is no guarantee that Ocera will be able to develop and bring OCR-002 to market.

This article is part of Seeking Alpha PRO and is available to you on a ti