How To Invest In Biotech

Comment Now

Follow Comments

Disclosure: I own AMGN and GILD stocks

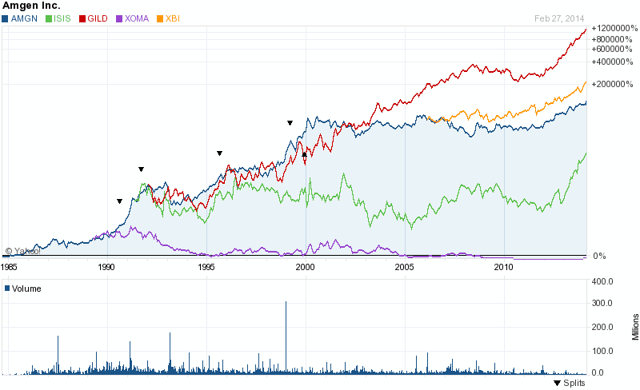

Biotech stocks have been getting a great deal of attention on Wall Street in the last twelve months, with the SPDR S&P Biotech ETF (NYSE: XBI) outperforming the NASDAQ market by a big margin. Intercept Pharmaceuticals ICPT +5.5% is up more than 13-Fold from its 52-Week lows.

For investors who have been around Wall Street long enough, such phenomenal gains invoke memories of the biotech bubble of the 1980s, which was fueled by FDA approval of several blockbuster drugs — including Amgen's AMGN +1.8% Epogen and Aranesp anemia drugs.

Since then, very few biotechnology companies have followed Amgen’s success winning FDA approval for their own blockbuster drugs.

But one of these companies is Gilead Sciences GILD +1.87%, which developed Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost, and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults; and Sovaldi, Viread, and Hepsera products for the treatment of liver disease.

That’s why Gilead’s stock caught up and eventually surpassed Amgen’s. Other companies like Isis Pharmaceuticals have been struggling for years to catch up; or remain underwater like Xoma Corporation.

That’s why Gilead’s stock caught up and eventually surpassed Amgen’s. Other companies like Isis Pharmaceuticals have been struggling for years to catch up; or remain underwater like Xoma Corporation.

A third group managed to get FDA approval for its drugs, but failed to market them effectively (e.g.,Dendreon and Affymax AFFY NaN%).

A fourth group–the largest by far–has failed to produce any successful drug, leaving investors holding the bag.

These observations point to the difficulties of picking winners in the biotechnology industry.

What are the strategies?

A conservative strategy is to stay with established biotechnology companies like Amgen and Gilead Science, with sound financials. Both companies trade at a reasonable PE while enjoying hefty operating margins and revenue growth rates.

| Company | Forward PE | Operating Margins | Qtrly Revenue Growth (yoy) | Qtrly Earnings Growth (yoy) |

| Amgen | 14.26 | 32.46% | 13.30% | 29.60% |

| Gilead Sciences | 14.60 | 40.39 | 20.50 | 3.80 |

Source: Yahoo.Finance.com

Another conservative strategy is to buy into a biotechnology fund like SPDR S&P Biotech ETF (NYSE:XBI), which tracks the performance of the S&P Biotechnology Select Industry Index. With this strategy, you must keep an eye on the industry, rather than company fundamentals, which are promising — given the proliferation of new technologies that speed up the R&D process, and the aging of the US world population, which fuels the demand for new drugs.

Now, a speculative strategy. Try to pick up winners among biotechnology start-ups.

I usually apply two criteria. First, look for companies with drugs treating rare and devastating diseases, being in stage II or III of testing.

Second, look at companies that have received recent FDA approval for one of their drugs — though I wait for a correction before I buy.

And I spread my bets to several stocks.

One of the companies that seems to satisfy my criteria is Intercept Technologies. The company’s liver-disease drug, called obeticholic acid, or OCA, has performed unexpectedly well in a clinical trial.

One of the companies that seems to satisfy my criteria is Intercept Technologies. The company’s liver-disease drug, called obeticholic acid, or OCA, has performed unexpectedly well in a clinical trial.

These results may win the company an expedient FDA approval. But as history shows, the road may be bumpy. The problem is, in this case, that the stock has already reached a valuation of close to $8 billion.

But does the potential market for a drug justify the company’s current valuation?

ICPT key statistic11s

| Market cap (intraday) | 7.94B |

| Shares Outstanding | 19.34M |

| %Held by insiders | 42.7% |

| %Held by institutions | 26.10% |

| Revenue | 1.62M |

| Operating Cash Flow | -21.87M |

Source:Yahoo.Finance.com3/2/14

Obviously, investors chasing after Intercept Technologies’s shares think so.

As I wrote in a previous piece, I would be skeptical, for a number of reasons:

First, we are talking about a drug that performed well in a statistical trial, not a drug that has already received FDA approval.

Second, even if OCA receives an expedient FDA approval, marketing success is no guarantee. Investors have to look no further than the fate of Dendreon’s drug PROVENGE, which received FDA approval a few years ago.

Third, even if OCA passes both the FDA and a market test, at the current valuation, the company is valued at 10 percent of the value of Amgen Inc., which has been around for more than three decades and has several blockbuster stocks in the market.

Investors who have been around Wall Street long enough remember EntreMed Inc., another biotechnology company that displayed a similar performance in a short period.

We all know what happened in that case.

The bottom line: Investing in biotechnology stocks is a tricky business, especially when it comes to picking up winners among smaller biotechnology companies without a product in the market.

That’s why this strategy is for aggressive investors only.