This would not be ideal for equity markets, however, we would point out that should Mr. Putin decide to draw the line at the current areas his troops have occupied, then this might be an agreeable outcome for the world. The US cannot afford a re-escalation of the Cold War and Europe cannot afford to have their energy supplies cut off by Russia.

Chart of the Day:

The

US 10-year found support in the 2.70% range recently, but with the news

out of Ukraine we have once again seen a rush to safety, pushing yields

further down. We would not be buyers now, but rather sellers. Our focus

is upon high quality equities, regardless of the geopolitical events

surrounding Ukraine.(click to enlarge)

Source: Yahoo Finance

We have economic news today and it is as follows:

- Personal Income (8:30 a.m. EST): Est: 0.3% Act: 0.3%

- Personal Spending (8:30 a.m. EST): Est: 0.1% Act: 0.4%

- PCE Prices - Core (8:30 a.m. EST): Est: 0.1% Act: 0.1%

- ISM Index (10:00 a.m. EST): Est: 51.6 Act: 53.2

- Construction Spending (10:00 a.m. EST): Est: -0.1% Act: 0.1%

- Auto Sales (2:00 p.m. EST): Est: N/A

- Truck Sales (2:00 p.m. EST): Est: N/A

- All Ordinaries -- down 0.38%

- Shanghai Composite -- up 0.92%

- Nikkei 225 -- down 1.27%

- NZSE 50 -- up 0.35%

- Seoul Composite -- down 0.77%

- CAC 40 -- down 2.49%

- DAX -- down 3.01%

- FTSE 100 -- down 1.88%

- OSE -- down 2.00%

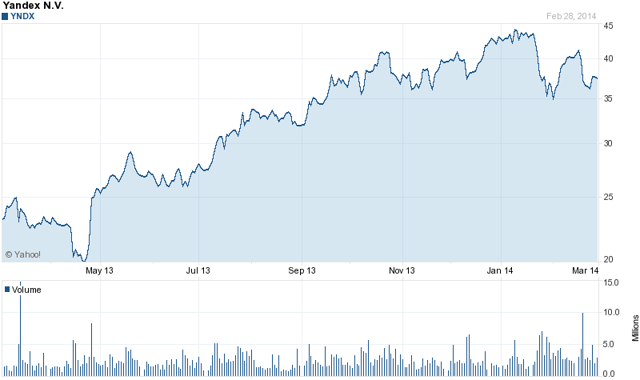

Russian Stocks Getting Slammed

The companies taking the brunt of the hit today are those with Russian exposure, namely Yandex (YNDX), Qiwi PLC (QIWI) and VimpelCom Ltd. (VIP).

All names are down over 6% as investors exit positions in order to

lower their exposure to the Ukrainian situation. For those who are

long-term investors and currently able to take on risk, some of these

names might be quite attractive on the pullback, especially Yandex,

which is Russia's top search engine and Qiwi PLC, which is the Russian

equivalent to PayPal. Qiwi PLC also has a lucrative debit card business,

which is slower growth than the online wallet business, but still

strong with low double digit growth.With shares falling to the $30-32/share support area, long-term investors might find this a buying opportunity. If not here, then certainly the $26-27/share area.

(click to enlarge)

Source: Yahoo Finance

The Russian ruble is trading at fresh lows versus the dollar, but this is of little concern to Putin and the Russian leaders. Speculators will move in and out of the Russian equities as they place their bets, but we would look to the currency and bond traders for guidance as to when this ordeal will be close to concluding. Those traders tend to be more on the money than equity traders when it comes to these types of situations.

Apple's New Tech

Everyone has been waiting for Apple (AAPL)

to roll out its next new big idea, and CEO Tim Cook has repeatedly

stated that the company has a stable of new products to release in the

coming years. Our fear, however, is that most of these new products will

look like CarPlay, the new technology offering that helps to further

integrate Apple products into the lives of the tech savvy by simply

building upon features that already existed to an extent.We still have faith in Apple long term, and think that there is tremendous value in the company's shares, but we do think that the management team needs to fast track some of these rumored items so that the shareholders are not disappointed again this year should the company not release a product that takes it into a new market.

For the stock to move higher from these levels, Apple will have to do more in terms of hardware products and fewer products such as CarPlay.

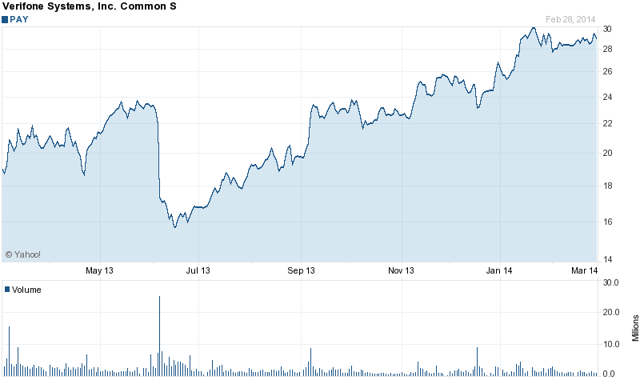

Good News for Verifone

Shareholders in Verifone (PAY)

received some good news, as it is being reported that Square has

postponed its plans for an IPO. Square was at the root of some of the

issues facing Verifone during its recent troubles and forced the company

to focus on its more lucrative business lines, effectively beating

Verifone out of the low margin and highly competitive small business

market. The IPO delay seems to highlight the issues with Square's

ability to grow the company as well as the size of its current revenues, which are above $100 million.After originally being bearish on the name, we did turn bullish after the big sell-off. With the IPO of Square being postponed, we think that the name might have further upside potential.

(click to enlarge)

Source: Yahoo Finance

With one of the up-and-coming competitors now sidelined and forced to wait another year before having an IPO, it gives Verifone further time to prepare for when Square does have access to capital markets and a large stash of cash.

No comments:

Post a Comment