Carnival time is coming soon and while you ponder the possibility of going on a nice little vacation to Rio de Janeiro, I urge you to reconsider - save your vacation money and invest in Brazil instead. Now may be the best time to buy into the Brazilian ETF (EWZ) and make some extra money for that first-class trip to the Olympics in 2016.

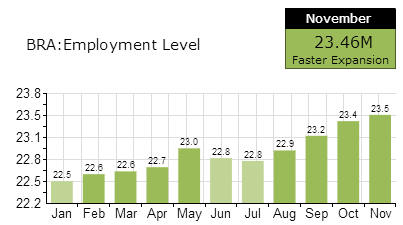

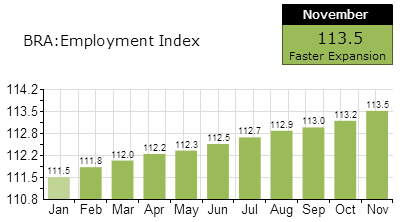

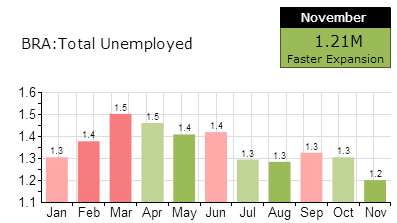

Booming Employment

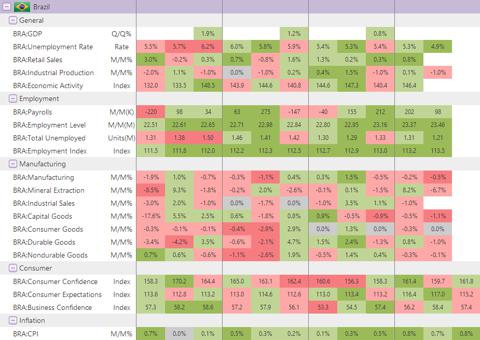

Unlike the US and Europe, the Brazilian employment picture couldn't get any rosier. Brazil has added over 1 million jobs in 2012. From August till November alone, the country's adjusted payrolls are plus 670,000 jobs. The Employment Index is steadily rising and the total number of unemployed is steadily declining.

Source: macrochart.com

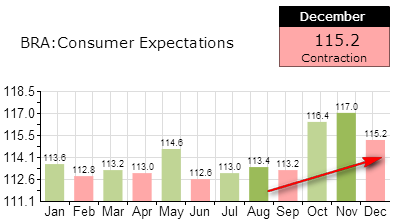

Strong Consumer Sector

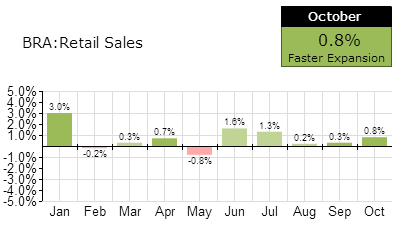

Rising employment and wage growth is great news for the consumer sector of Brazil (67% of the economy) and that is confirmed by great retail sales readings (only 2 small down months in the past year), rising consumer expectations and the outstanding performance of the Global X Brazil Consumer ETF (BRAQ) - up +24.5% in 6 months!

Source: finance.yahoo.com

Manufacturing Weakness

The manufacturing numbers are a little disconcerting. Industrial Production was down -1.0% for two out of the last 3 months. Manufacturing has contracted for 3 straight months. Capital goods sales are down 4 months in a row. The durable goods and nondurable goods sales are mixed as well. As you can see in the Economic Heatmap below, the manufacturing sector has more red and pink (meaning contraction) than I would like, but let's not forget that industrial production is only 27% of the economy. And right now is the middle of the summer in Brazil so this could just be seasonal weakness. In any case, the Banco de Brazil Economic Activity Index has shown good resilience and at 146.4 is much higher than the 132.00 reading at the beginning of 2012.

Source: macrochart.com

Big Events means guaranteed Economic Growth

There a few big events that are coming to Brazil in the near future which are driving a boom in infrastructure and housing construction and the tourist industry:

2013 - The Confederation Cup

2014 - The World Cup

2015 - 450th Anniversary of Rio de Janeiro

2016 - The Summer Olympic Games

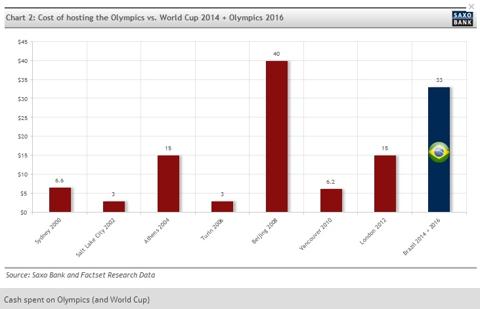

Rio de Janeiro already enjoys about 1.4 million visitors per year and tourism is expected to double to around 3.3 million for these events. The combined spending outlay on the World Cup and the Olympics is estimated to be around 33 billion USD, second only to the Beijing Olympics in recent memory:

Some of the effort for these events has already started, but there is still a lot of work left to do and that guarantees solid employment and economic growth for the next 3 years. While the GDP has had declining rates of growth, I expect that to reverse in 2013 with the economy pushing higher in anticipation of the World Cup in 2014 and benefiting from the relatively weak real.

Invest Now or Invest Later

The question is not whether to invest in Brazil, but when. The markets are at an inflection point right now. If we get a significant selloff in the US, this may spill over into emerging economies.. or it may not. I don't know. Clearly the BRAQ ETF is a terrific investment opportunity given the strength of the consumer sector in Brazil and you should buy into it as soon as possible. The EWZ, on the other hand, is at an important junction from a technical perspective:

Source: tdameritrade.com

There are several technical indicators that point to a potential strong upward breakout:

- Double bottom that formed over a 6 month period

- The index has spent about 3 weeks knocking at the 57.50 resistance level (big red line)

- Upward moving 200-day moving average

- Price action was above the 10-day average and on the upper Bollinger band for about 3 months prior to stalling and consolidating in the last 3 weeks

- Bollinger bands are narrowing significantly pointing to a breakout

- The gap that opened at 56.10 has been defended for 3 weeks (small green line)

So this either breaks the resistance at 57.50 or breaks support below 56.10. Don't do anything until one of those lines is broken. If you get a close above 57.50, this is a must buy. The Double Bottom suggests that the upward move may go up an additional 7.5 points once the neckline is broken with a target of 65. If there is a selloff and the price breaks 56.10 to the downside, then wait for a better entry point in the red support area between 50 and 53. At that point, the pattern will become a triple bottom which is an even more powerful reversal pattern and you might as well backup the truck and buy as much as you can - lock, stock and two smoking barrels.

For more information on what constitutes the Brazil ETFs, please read theEmerging Market ETFs: Brazil article by Nathaniel Matherson.

No comments:

Post a Comment