Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

For the past 10 years, Brazil was the ideal emerging market, recording solid growth, decreasing poverty, and a growing middle class. Its GDP surpassed Britain and Italy in the last few years, and is, or perhaps was, on track to overtake France in the near future. These rapid growth rates made Brazil one of the hottest targets in the emerging market craze of the past few years. However, in the last year, Brazil has begun to fall out of favor with investors.

As I've mentioned in a previous article, one of the biggest issues with emerging market economies is their exposure to China. It's pretty widely accepted that China's growth is slowing (whether or not it will be a hard or soft landing is still debated), and China will need to make a transformation to consumption to sustain its GDP. This means that construction will slow, and the demand for raw materials will begin to slow with it.

This is bad news for countries like Brazil who rely on a vast materials sector with large, industry leading companies such as Vale (VALE). This is made evident by the most popular and liquid ETF tracking the region:iShares MSCI Brazil Index Fund (EWZ). This ETF has lost about 26.7% over the last year (see chart below, with EEM in orange and EWZ in blue).

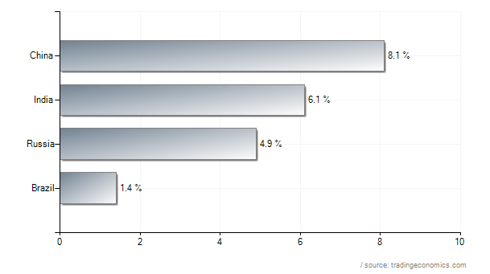

This drop was the result of the poor GDP numbers that Brazil reported recently. According to an article in The Economist, Brazil grew just 2.7% last year, and had a particularly poor Q4 where GDP only expanded at 1.4% compared to 5.4% in Q4 2010. The chart below compares that Q4 growth rate to the other BRICS, and makes it pretty obvious Brazil is falling behind.

There are a few explanations for this. My first and foremost explanation is that it is simply too correlated with sustained growth in demand from China. As material and raw good demand from China slows, many of Brazil's largest companies are going to slow with it. And if we take that out one more step, if Brazil's largest companies begin to stagnate, Brazil's economy is going to slow as well.

Another issue is that Brazil is yet another country that is beginning to depend on consumption to keep it's GDP sustainable. Everything was going well for the past 5-6 years as unemployment was decreasing and the middle class was growing. However, over the last year, unemployment has taken a turn for the worse. After hitting a low of 4.7-ish% in January 2012, it has jumped back up to 6.2% by March (see chart below). This is obviously a pretty worrying trend, and one that will require a great deal of attention if it continues to increase in the coming months.

If you need more issues there is also: a strong currency (although it is currently weakening) which has led to a fairly significant decrease in exports over the last few quarters, a very poor infrastructure system that is going to take a lot of investment to get up to speed before the World Cup in 2014, and (EWZ specific) about 40% of the main ETF is allocated to energy and materials that vary based on oil prices and material demand from China specifically.

All that being said, I'm well aware that investors in emerging markets are okay with the risks, and are content with it as long as the risk leads to returns. But once again in the chart below (I like graphical representations, and statistics to back up my ideas), we see that EWZ has severely underperformed SPY (the SPDR S&P 500 Trust ETF) over the last year. So really for the extra risk, investors have simply been punished over the last year instead of rewarded.

It's not all doom and gloom though, there are some catalysts for Brazil going forward. In the next four years, Brazil will host two of the biggest sporting events in the world - the World Cup in 2014 and the Olympics in 2016. This will force Brazil to get it's infrastructure up to speed, which will not only improve life for its citizens, but also for its companies. I also mentioned the unemployment rate earlier - when the World Cup comes to town in 2014, I expect to see a significant drop as jobs are created, and cash begins to flow (at least for retail, transport, food, and hotels).

Growth in the developed world is beginning to slow, and investors are continually looking to the developing world for growth. Brazil has delivered before, but is it worth taking the risk to see if it delivers again? My answer is no.

2 comments:

http://cyprustoday.net/news/index.php/prep-girls-basketball-cyprus-relies-on-defense-to-spark-offense/#comment-

I just love your blog.Thanks for posting it.Web Design Pakistani have something that someone comeback again….there is a lot of useful information a person can get from here…I must say,well done..free legal help

.i visited it daily,what a colourful blog it is....colours attracted me a lot....i visited it daily,what a colourful blog it is.... a very decent and nice blog...i like it so very much...

Post a Comment