Shares of YY (YY) have risen more than 40% in less than a month and are up 140% since my initial article

on the company in early June 2013. While the price is extended at the

moment, and the stock could pull back in the next couple of weeks, YY

has much more potential given its growth prospects and strategic

initiatives. YY is still trading at a significant discount to growth,

and I believe that the forward estimates will be revised higher in the

coming months, which might propel the share price even higher from

current levels. My price target is $126, as I believe that analysts are

largely understating the company's growth prospects.

Strong growth will continue

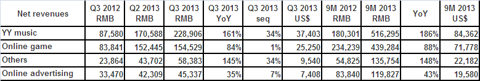

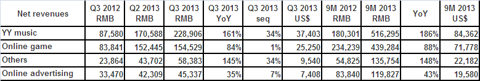

YY has grown revenue and earnings in triple digits since going public in late 2012, while profit margins have expanded along the way as the company scales its business. Revenue growth has been strong in all four business segments, and YY Music segment has shown the strongest momentum, with Q3 revenue growing 161% year-over-year, while the segment's revenue increased 184% in the first nine months of 2013.

(click to enlarge)

Source: YY Q3 report

YY Music's strong momentum can be attributed in part to the exclusive partnership with Hunan TV, which brought the popular Happy Boy Show to YY's interactive internet platform. While the collaboration ended, management expects strong momentum of YY Music to be sustained in the future. And YY Music also had strong momentum before the Hunan partnership, since YY Music delivered Q2 2013 revenue growth of 193%. And even if the YY Music momentum stalls (which I do not expect at this point), there are other areas of strength, such as online gaming, and future projects that I will talk about later, which will drive growth in the next couple of years.

New strategic partnership

YY announced a new strategic partnership in late October 2013 with Asiasoft and S2 Games. The partnership enabled YY to license S2 Games' Strife, and will jointly operate the title with Asiasoft, the leading provider of online gaming services in Southeast Asia. Strife was developed by S2 Games, the developer of award-winning hit title Heroes of Newerth. Strife is a free-to-play, Multiplayer Online Battle Arena ("MOBA") title which was slated to start its beta test in Q4 2013, with a scheduled release in early 2014.

This partnership is important for YY in more than one way. It will enable the company to expand outside of China and into international gaming. YY also gets immediate access to Asiasoft's 60 million registered users, and it's adding a highly anticipated S2 Games' title to its gaming portfolio. YY will jointly market, distribute and operate the global version of Strife on an integrated platform with Asiasoft in Thailand, Vietnam, Indonesia, Singapore, Philippines and Malaysia. I expect the partnership to have a meaningful impact on the gaming segment's revenue in 2014 and beyond.

Four major growth drivers in the next couple of years

YY has four meaningful potential growth drivers:

1. Gaming. As mentioned before, YY's partnership with Asiasoft and S2 Games will have a meaningful impact on growth of gaming revenue for the company. Another important consideration here is mobile monetization. The company has established a mobile game team, and is currently aiming at two directions: to increase efforts in mobile game development and to leverage YY's resources to increase traffic. Management said on the Q3 conference call that they are looking to capitalize on the power of the YY platform. The company also has a game portal Duowan.com which has strong traffic on the PC front, and it is consolidating a lot of apps on Duowan.com into mobile apps. This consolidation will contribute to the future growth of the mobile game platform, which is under development. However, the company is still in an early stage of mobile development, and has just recently started to monetize the mobile platform, and we should expect some metrics on mobile monetization soon, and we will be able to better grasp its potential.

2. Education. Online education is experiencing strong growth in China. YY had 125,000 teachers in Q3, which was a 29% sequential increase. The company is still working on a model that is suitable for the YY platform. YY has approximately 3 million monthly active users who come to YY for education purposes. Since the company is currently focused on developing the product and technology, the monetization is expected to be dealt with in a later stage. Management expects to focus on monetizing the education segment in the second half of 2014 or later. Education might be an important growth driver for the company in 2015 and beyond.

3. International expansion. YY started to look beyond China with the S2 Games and Asiasoft partnership. The partnership will enable the company to expand its operations and its brand in Asia. The company also announced in Q3 the departure of its CTO, Tony Zhao. Although Zhao is leaving, YY will form a strategic partnership with his new Silicon Valley startup, and will focus on leveraging YY's platform to expand into promising new verticals internationally. I expect we should soon find out more about this.

4. Mobile monetization. This is perhaps the most important issue for the company going forward. YY is still at an early stage of mobile monetization, and the field holds the most promise for growth in the future. Another important factor is the development and transition to 4G in China, which is under way, and which will enable faster connection and increased user engagement. People in China are mostly using the slow 2G and/or 3G, and this is limiting user experience. Perhaps one of the most important announcements regarding 4G was the China Mobile and Apple agreement in late December 2013. In early December, Beijing issued 4G licenses to all three nationwide telecommunications network operators, and we should see rapid adoption and expansion of 4G in China in 2014 and beyond. This in turn might help YY grow its mobile user base and mobile engagement significantly going forward.

Valuation and 2014 and 2015 growth expectations

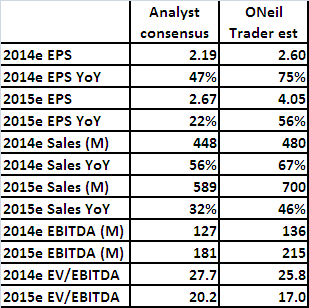

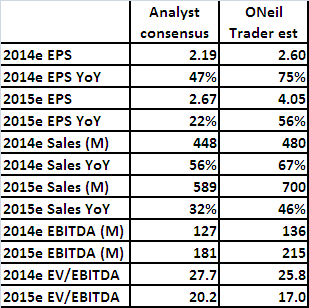

YY is currently trading in the upper range of its valuation since going public (see EV/EBITDA chart below). The company will soon announce Q4 earnings, and the ratio is bound to go down due to a sequential rise of EBITDA. Given the growth levels YY is delivering, a forward EV/EBITDA ratio of 30 to 40 would be considered conservative.

TTM) Chart">

TTM) Chart">

This forward expectation should be revised down if the growth slows down significantly in the following quarters, which I do not expect at this point of the company's expansion phase. Continued momentum in the current business segments, coupled with new monetization efforts in mobile gaming and education and international expansion should keep revenue and earnings growing north of 50% in the next couple of years. Based on the EV/EBITDA multiple of 30 for 2015, and my estimates for 2015, the price target I arrived at is $126, which is 76% higher than the current price. If you take the analyst consensus estimate, the estimated upside would be around 50%. However, shares of YY have run up 40% in a short time-frame, and are vulnerable to a pullback. I would use an eventual pullback to buy shares.

Catalysts

Catalysts that could push shares of YY higher might be:

- YY is due to report Q4 earnings soon (date of release is still not available). If YY continues to beat earnings and sales estimates, the stock should continue to rise. FY 2014 guidance would also have a meaningful impact, especially if it is significantly better than current estimates.

- New sell-side coverage and raised estimates. Six analysts currently cover the stock with one strong buy, four buy ratings and one hold. New analyst coverage and raised price targets might push the stock higher. YY is currently trading above the median price target of $63.

- New partnerships and acquisitions. New meaningful partnerships would increase the future expectations for the company. The company had close to $300 million in cash and equivalents at the end of Q3, and might use them for strategic acquisitions going forward. In fact, the company announced a note offering in November, with the intent to buy back shares or use it for acquisitions, but has pulled the offering a few days later.

Risks

-The main risk related to YY is China that it is doing business in China. There have been numerous scandals with Chinese stocks, and investors are concerned with accounting risks and potential fraud. Caution is advised with investing in Chinese companies.

- The other issue is China's slowing economic growth and the impact on Chinese stocks. YY has largely ignored the weakness in Chinese equities, and showed impressive relative strength in recent weeks, as did many Chinese small caps, as evidenced in the charts of Guggenheim China Small Cap ETF (HAO) and iShares FTSE China 25 ETF (FXI).

(click to enlarge)

Source: stockcharts.com

- YY also faces stiff competition in China and might not be able to expand geographically into other parts of Asia successfully.

Conclusion

Although YY has gone up 40% in less than one month, the stock still has plenty of potential. I would use any weakness in the share price to buy shares. My price target of $126 is much higher than the current price and the current consensus estimates, based on the future growth prospects. I believe that the stock will outperform the market in 2014, notwithstanding an adverse macro event in China or in the U.S.

Additional disclosure: This article is for informational and educational purposes only, and should not be considered as investment advice.

Strong growth will continue

YY has grown revenue and earnings in triple digits since going public in late 2012, while profit margins have expanded along the way as the company scales its business. Revenue growth has been strong in all four business segments, and YY Music segment has shown the strongest momentum, with Q3 revenue growing 161% year-over-year, while the segment's revenue increased 184% in the first nine months of 2013.

(click to enlarge)

Source: YY Q3 report

YY Music's strong momentum can be attributed in part to the exclusive partnership with Hunan TV, which brought the popular Happy Boy Show to YY's interactive internet platform. While the collaboration ended, management expects strong momentum of YY Music to be sustained in the future. And YY Music also had strong momentum before the Hunan partnership, since YY Music delivered Q2 2013 revenue growth of 193%. And even if the YY Music momentum stalls (which I do not expect at this point), there are other areas of strength, such as online gaming, and future projects that I will talk about later, which will drive growth in the next couple of years.

New strategic partnership

YY announced a new strategic partnership in late October 2013 with Asiasoft and S2 Games. The partnership enabled YY to license S2 Games' Strife, and will jointly operate the title with Asiasoft, the leading provider of online gaming services in Southeast Asia. Strife was developed by S2 Games, the developer of award-winning hit title Heroes of Newerth. Strife is a free-to-play, Multiplayer Online Battle Arena ("MOBA") title which was slated to start its beta test in Q4 2013, with a scheduled release in early 2014.

This partnership is important for YY in more than one way. It will enable the company to expand outside of China and into international gaming. YY also gets immediate access to Asiasoft's 60 million registered users, and it's adding a highly anticipated S2 Games' title to its gaming portfolio. YY will jointly market, distribute and operate the global version of Strife on an integrated platform with Asiasoft in Thailand, Vietnam, Indonesia, Singapore, Philippines and Malaysia. I expect the partnership to have a meaningful impact on the gaming segment's revenue in 2014 and beyond.

Four major growth drivers in the next couple of years

YY has four meaningful potential growth drivers:

1. Gaming. As mentioned before, YY's partnership with Asiasoft and S2 Games will have a meaningful impact on growth of gaming revenue for the company. Another important consideration here is mobile monetization. The company has established a mobile game team, and is currently aiming at two directions: to increase efforts in mobile game development and to leverage YY's resources to increase traffic. Management said on the Q3 conference call that they are looking to capitalize on the power of the YY platform. The company also has a game portal Duowan.com which has strong traffic on the PC front, and it is consolidating a lot of apps on Duowan.com into mobile apps. This consolidation will contribute to the future growth of the mobile game platform, which is under development. However, the company is still in an early stage of mobile development, and has just recently started to monetize the mobile platform, and we should expect some metrics on mobile monetization soon, and we will be able to better grasp its potential.

2. Education. Online education is experiencing strong growth in China. YY had 125,000 teachers in Q3, which was a 29% sequential increase. The company is still working on a model that is suitable for the YY platform. YY has approximately 3 million monthly active users who come to YY for education purposes. Since the company is currently focused on developing the product and technology, the monetization is expected to be dealt with in a later stage. Management expects to focus on monetizing the education segment in the second half of 2014 or later. Education might be an important growth driver for the company in 2015 and beyond.

3. International expansion. YY started to look beyond China with the S2 Games and Asiasoft partnership. The partnership will enable the company to expand its operations and its brand in Asia. The company also announced in Q3 the departure of its CTO, Tony Zhao. Although Zhao is leaving, YY will form a strategic partnership with his new Silicon Valley startup, and will focus on leveraging YY's platform to expand into promising new verticals internationally. I expect we should soon find out more about this.

4. Mobile monetization. This is perhaps the most important issue for the company going forward. YY is still at an early stage of mobile monetization, and the field holds the most promise for growth in the future. Another important factor is the development and transition to 4G in China, which is under way, and which will enable faster connection and increased user engagement. People in China are mostly using the slow 2G and/or 3G, and this is limiting user experience. Perhaps one of the most important announcements regarding 4G was the China Mobile and Apple agreement in late December 2013. In early December, Beijing issued 4G licenses to all three nationwide telecommunications network operators, and we should see rapid adoption and expansion of 4G in China in 2014 and beyond. This in turn might help YY grow its mobile user base and mobile engagement significantly going forward.

Valuation and 2014 and 2015 growth expectations

YY is currently trading in the upper range of its valuation since going public (see EV/EBITDA chart below). The company will soon announce Q4 earnings, and the ratio is bound to go down due to a sequential rise of EBITDA. Given the growth levels YY is delivering, a forward EV/EBITDA ratio of 30 to 40 would be considered conservative.

TTM) Chart">

TTM) Chart">This forward expectation should be revised down if the growth slows down significantly in the following quarters, which I do not expect at this point of the company's expansion phase. Continued momentum in the current business segments, coupled with new monetization efforts in mobile gaming and education and international expansion should keep revenue and earnings growing north of 50% in the next couple of years. Based on the EV/EBITDA multiple of 30 for 2015, and my estimates for 2015, the price target I arrived at is $126, which is 76% higher than the current price. If you take the analyst consensus estimate, the estimated upside would be around 50%. However, shares of YY have run up 40% in a short time-frame, and are vulnerable to a pullback. I would use an eventual pullback to buy shares.

Catalysts

Catalysts that could push shares of YY higher might be:

- YY is due to report Q4 earnings soon (date of release is still not available). If YY continues to beat earnings and sales estimates, the stock should continue to rise. FY 2014 guidance would also have a meaningful impact, especially if it is significantly better than current estimates.

- New sell-side coverage and raised estimates. Six analysts currently cover the stock with one strong buy, four buy ratings and one hold. New analyst coverage and raised price targets might push the stock higher. YY is currently trading above the median price target of $63.

- New partnerships and acquisitions. New meaningful partnerships would increase the future expectations for the company. The company had close to $300 million in cash and equivalents at the end of Q3, and might use them for strategic acquisitions going forward. In fact, the company announced a note offering in November, with the intent to buy back shares or use it for acquisitions, but has pulled the offering a few days later.

Risks

-The main risk related to YY is China that it is doing business in China. There have been numerous scandals with Chinese stocks, and investors are concerned with accounting risks and potential fraud. Caution is advised with investing in Chinese companies.

- The other issue is China's slowing economic growth and the impact on Chinese stocks. YY has largely ignored the weakness in Chinese equities, and showed impressive relative strength in recent weeks, as did many Chinese small caps, as evidenced in the charts of Guggenheim China Small Cap ETF (HAO) and iShares FTSE China 25 ETF (FXI).

(click to enlarge)

Source: stockcharts.com

- YY also faces stiff competition in China and might not be able to expand geographically into other parts of Asia successfully.

Conclusion

Although YY has gone up 40% in less than one month, the stock still has plenty of potential. I would use any weakness in the share price to buy shares. My price target of $126 is much higher than the current price and the current consensus estimates, based on the future growth prospects. I believe that the stock will outperform the market in 2014, notwithstanding an adverse macro event in China or in the U.S.

Additional disclosure: This article is for informational and educational purposes only, and should not be considered as investment advice.

No comments:

Post a Comment