Tesla: Is Another Major Short Squeeze Coming?

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Tesla Motors (TSLA)

was one of the most surprising and impressive stocks of 2013. The

company's staggering rally gave the stock cult status, and it became one

of the biggest battleground stocks on this website and many others for

several months. As 2013 ended and 2014 has begun, Tesla's stock has

calmed down and now investors can probably start to focus a little more

on the business and not the day-to-day movements of the stock. In

mid-December, I discussed how short interest in Tesla was starting to spike again.

I noted that while a short squeeze didn't seem extremely possible at

that point, I would continue to watch the numbers. Well, the end of 2013

numbers are out, and a short squeeze is definitely becoming more

possible. Today, I'll look at the latest short data for Tesla and

discuss where the name stands now.The latest update:

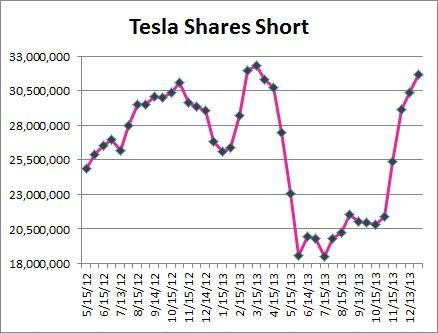

We have now seen five consecutive increases in Tesla's short interest, with the end of December update being the latest one. Yes, short interest numbers are usually delayed by about 10 days to 2 weeks, but it takes a while to get all of the data and then report on it. The importance is that you can definitely spot trends in sentiment regarding certain stocks. For Tesla, as seen in the chart below, short interest has rocketed higher.

In the final few weeks of December, short interest increased by 1.3 million shares, following a nearly 1.2 million increase in the first half of the month. The jump in December follows a nearly 7.75 million share increase in November. Tesla's short interest bottomed out just under 18.5 million shares back in July. Since then, short interest is up by more than 13 million shares, a rise of 71%. This is a significant move, and it puts short interest at its highest point since the middle of March.

Tesla Motors has become a highly shorted stock again. According to Yahoo! Finance, the company had 122.59 million shares outstanding at the end of Q3 and as well as a float of 83.89 million. That means that 25.82% of the outstanding share count and 37.73% of the float is shorted. This can easily lead to a short squeeze on good news. We've seen this happen before with Tesla, during 2013, and with other momentum favorites such as Netflix (NFLX), Green Mountain Coffee Roasters (GMCR), and Deckers Outdoor (DECK), just to name a few.

The short count isn't the only thing rising:

The other interesting item to look at for Tesla is the days to cover ratio. This is a measure that calculates the number of days it would take all short sellers to cover, based on average volume. If a stock has 30 million shares short, and the average volume is 6 million, it would take 5 days for all shorts to cover. Some of my readers in the past have discussed the idea that the days to cover ratio for most stocks is a lot higher than the actual printed number. These readers argue that if you were to eliminate day traders and other short term traders (like computer trading), the actual volume would be much lower, and thus the days to cover ratio would be higher. It is a good point, but unless we had concrete volume statistics on those types of traders, we can't really calculate that higher number. For that reason, I will continue to only use the days to cover number as provided by NASDAQ going forward.

At the latest short interest update, Tesla's days to cover ratio was 4.08. Usually, I don't consider a number less than 5 to indicate a potential short squeeze, when the days to cover ratio is looked at in isolation. As the days to cover ratio gets into the high single digits or double digits, it makes a short squeeze even more possible. However, Tesla's days to cover ratio was just 2.04 at the end of November, and as low as 1.18 earlier in 2013. Why has this number suddenly spiked? Obviously, the ratio should rise as short interest increases.

Also, Tesla's daily volume has really dropped. In November, only three trading days saw daily volume of less than 10 million shares. Between the start of December and December 19th, there were six days that saw volume of less than 10 million. From December 20th until last Friday, volume did not touch 10 million in any single day, and there was only one day where it topped 8 million. Yes, part of that is due to the holidays, but it also may be due to Tesla fatigue. When volume comes down, it helps to push the days to cover ratio up. When you combine the rising days to cover ratio with a large amount of the float short, it definitely makes a squeeze possible. Tesla's days to cover ratio is at its highest point since the end of April, when it was near 8.00. That's when short covering in the name really started to pick up, and shares rocketed higher during May.

Revenue estimates going higher:

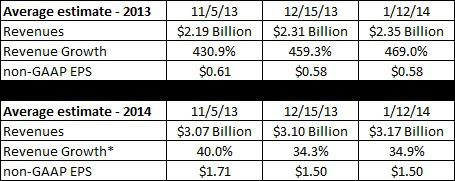

Tesla's short interest isn't the only number that's increasing. Analysts are increasing their revenues estimates for both 2013 and 2014. The table below shows Tesla's average revenue and earnings per share estimates for 2013 and 2014 going back to the third quarter report.

*Revenue growth number for 2014 based on current estimate for 2013 at that time. The 2013 number will continue to change until we get final yearly results from the company.

Analysts have continued to up their revenue numbers for Tesla, which makes sense given how Tesla has continued to beat revenue estimates handily in recent quarters. Unfortunately, despite a huge revenue beat in Q3, Tesla did not beat big on the bottom line. As a result, analysts have trimmed their earnings per share estimates on the name since Q3, although estimates are flat since my latest update. The key here is that analysts continue to believe in the growth story of Tesla. Now, it is up to the company to prove these analysts right.

Final thoughts:

Tesla's short interest has continued to spike higher, and when you combine that with much lower volume, it does appear that another short squeeze could be coming. Tesla's short interest is at its highest point since March 2013, and that was around the time shares started to rocket higher as investors began to cover. I'm tagging this article as a long idea on the basis that one piece of good news could lead to some significant short covering in this name, which could push this name substantially higher. However, investors do need to realize that this is a very risky play, and we could easily see a lot of covering with the stock falling if the next piece of news is bad. For now, analysts have been increasing their revenue estimates on the name, so expectations will be high going forward, especially for a stock that has rallied so much. One thing is sure. With every short interest update showing higher and higher short interest, the chances of a squeeze have jumped dramatically in the past two months.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

No comments:

Post a Comment