Did Goldman Sachs Just Call The Top In SolarCity?

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

After warning investors back during mid-May to not fall for the hype on the soaring SolarCity (SCTY),

the stock spent the next five months in a downtrend. Only recently had

the stock moved slightly higher than the warning level until Goldman Sachs (GS) issued an upgrade that caused the stock to soar over 11% at one point to a new all-time high at $67.14.SolarCity is a leader in the rooftop solar panel market and famously has Elon Musk as the Chairman of the Board. For those living under a rock, Elon is a revolutionary investor and inventor that is the CEO of both Tesla Motors (TSLA) and SpaceX. SolarCity offers solar power directly to consumers, businesses and government organizations for less than they spend on utility bills while taking care of the design and permitting process to get the panels installed. In addition, it handles all the monitoring and maintenance to ensure the rooftop solar panels continue to work properly.

The stock ended the day down 5% from the initial highs bringing up questions whether the Goldman Sachs upgrade caused a short-term spike allowing traders to exit their positions. In essence, did the call create a top in the stock? Though apparently not a major concern to Goldman and other investors that have pushed the stock up to astronomical values, the company has yet to prove how providing all those services to consumers at low costs actually generates profits. Remember, what is good for the consumer isn't always good for the business and ultimately the investor.

Goldman Sachs Call

On Monday morning, Goldman upgraded SolarCity to a buy from neutral forecasting that the company would benefit from fast rooftop solar-installation growth. The investment bank increased the price target on the stock to $80 a share, from $65. The solar stock offers an intriguing value to Goldman considering it provides the best stock in the rooftop sector that offers the highest margin and least policy risk.

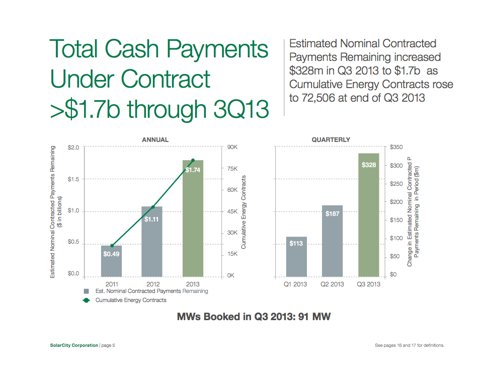

Nominal Contracted Payments

The excitement around the SolarCity trade revolves around the large remaining contracted payments from 20-year terms. As of the end of Q313, the estimated nominal contracted payments remaining soared to over $1.7 billion (see slide from Q313 presentation below). The numbers jumped significantly from the $1.1 billion at the end of Q312, so one can quickly see how investors get excited about the quickly rising payment stream.

(click to enlarge)

Investors need to keep an eye on the expense items carefully because payments are only part of the equation. In the latest quarter, operating expenses were $46 million. With operating expenses approaching a $200 million run rate, the nominal payments aren't looking that large anymore. Remember, these amounts don't even include the cost of revenues that were $8.4 million during Q3.

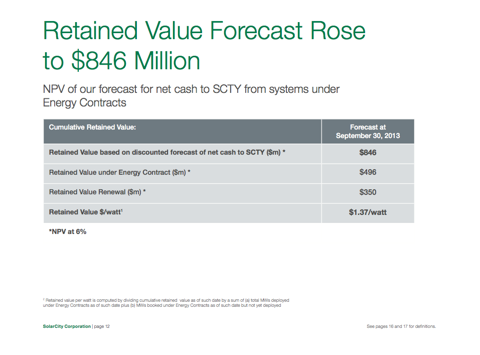

Retained Value

The retained value is where investors need to key onto the value proposition of the company. With a market valuation of around $5.5 billion (88 million diluted shares), the question should be why investors are willing to pay that much with the company defining the retained value as only $846 million, an increase from $662 million at the end of Q213.

(click to enlarge)

As the company explains in the definitions section copied below, the retained value is basically the net present value of the energy contracts with one large assumption. The retained value of the contracts is actually only $496 million with a big $350 million addition assuming 90% of customers agree to renew the contract for another 10 years. That number appears high considering customers will probably want new solar panels after 20 years. The outdated panels might even provide an aesthetic requirement to be replaced to prevent the house value from taking a hit.

Retained Value under Energy Contract represents the forecasted net present value of Nominal Contracted Payments Remaining and estimated performance-based incentives allocated to us, net of amounts we are obligated to distribute to our fund investors, upfront rebates, depreciation, renewable energy certificates, solar renewable energy certificates and estimated operations and maintenance, insurance, administrative and inverter replacement costs. This metric includes Energy Contracts for solar energy systems deployed and in Backlog.Conclusion

Retained Value Renewal represents the forecasted net present value of the payments SolarCity would receive upon Energy Contract renewal through a total term of 30 years, assuming all Energy Contracts are renewed at a rate equal to 90% of the contractual rate in effect at expiration of the initial term. This metric is net of estimated operations and maintenance, insurance, administrative and inverter replacement costs. This metric includes Energy Contracts for solar energy systems deployed and in Backlog.

No doubt SolarCity will generate more value in future years using the presented retained value calculation, but paying 11x the contracted value and 6.5x the bullish renewal case doesn't make a lot of sense. Sure Goldman Sachs is factoring in the NPV of future signed contracts, but it requires a substantial amount of new contracts in order to even match the current stock value, much less a jump to $80. Hence, such a call can signal a top in the stock especially when it gaps up and closes near the low for the day. The popularity of Elon Musk makes the stock almost impossible to short, but it sure doesn't offer any value at these levels.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

No comments:

Post a Comment