Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Market Overview

The market got whacked a bit

to start the week, but it bounced back nicely on Tuesday on the back of

solid retail data and decent enough earnings from

JPMorgan (JPM) and Wells Fargo (WFC).

On the economic data front, we got news about Retail Sales this morning

as well export/import prices. Sales were supposed to come in flat to

maybe up 0.1%. Some murmurs were that they would be negative, but they

beat all expectations coming in at 0.2%. Export/Import prices both

showed slight rises as well. That data is definitely a welcome site and

shows at least some better than expected sales during the Holidays.

Today was also the start of earnings season in our view with

JPMorgan

and Wells Fargo reporting earnings. JPM beat analyst expectations with a

1.30 EPS (1.24 estimates) and $24.1B revenue ($23.9B estimates). Yet,

the company was hurt by weakness in their investment bank and mortgage

unit. WFC saw a 6% drop in revenue but also beat expectations with 1.00

EPS (0.98) estimate). JPM has been mired by scandals/legal action, but

the company was able to see another drop in delinquency. Yet, there is

still general weakness in mortgage banking (applications down 50%+

year/year). WFC saw similar results, but they were "optimistic" about

2014.

Company News/Deeper Look

On the company news side, we will be focusing on Tesla Motors (

TSLA) today. Since there is a lot to cover, we will also make this our daily "deeper look" as well.

We

have been bearish on Tesla since the stock zoomed into triple digits.

We started out 2013 being bullish on the company, but we have thought is

too rich in valuation at these levels now. In recent articles, we have

laid out our bear argument. We first laid out our

bear argument on October 25, 2013.

In that article, we stressed that international success was necessary

to support the company's higher valuations, but we worried about their

promise. In

our latest article from December, we pushed that argument further.

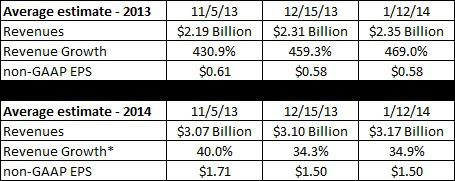

Main Catalyst

On Tuesday, Tesla stock rallied strongly on

several announcements from the company:

- Tesla delivered 6900 vehicles in Q4

- The company anticipates to see Q4 revenue at 20% higher than previous guidance

- Tesla is providing a software update "over the air" to 29,000 vehicle chargers to improve safety even further

These

three announcements allowed the stock to soar from in the red to over

10% in gains. What we want to do today is put these numbers into context

of the bigger picture and within in our main arguments about being

bearish on Tesla. We actually found these numbers to be quite

incredible, and they may have been the first signs that are some of our

original articles were well…wrong.

First off, we want to reiterate

some points we have brought up in previous articles. In our last

article, we noted that Tesla would be hard pressed to sell more than

15K-20K of their Model S per year:

YTD through October, the largest volume high luxury car sold

in the USA was the BMW 7-Series with just over 9000 units sold. That

puts the car on pace for 12K for the year. Even if Tesla can become the

top luxury car company in the USA, they would be pressed to sell more

than 15-20K of their current lineup and more than 30-40K with some of

the new cars they have in the pipeline. Thus, the company needs

international sales to reach the 90K level we are looking at for them.

In

the latest results, the company delivered about 6900 Model S sedans,

which would put them on pace for nearly 27,500 Model S sold per year.

The

most sold large luxury vehicle as of December 2013 was the Mercedes-Benz S-Class at 13K. In the

mid-size luxury,

the largest seller was the Lexus ES with 72K in sales. Now, the price

point for Model S makes it tough for it to ever reach these levels, and

the backlog of demand is strong for Model S now. The company is

delivering essentially everything they can make. At some point, these

levels come down, but we can say its safe to say 20K-25K Model S per

year for the next few years is definitely possible. That is an amazing

amount of high-end luxury cars to be selling.

The company also has the

Model X to debut

in the back half of 2014. The price point for this vehicle is expected

to be around the same as the Model S, so we are looking at a crossover

in the 60K-80K range. Once again, we cannot expect the company to hit

the levels of mid-level luxury SUVs that are in the 40K - 60K range, so

we have to look at the

Mercedes GL at 30K in volumes.

That level is around what we believe we can expect for the Model X,

potentially as much as 35K in the first couple years. In the best-case

scenario, we are looking at 2015 being a year where the company can sell

60K cars domestically.

The

Model E or Gen III

is expected to release in 2016-2017, and this is the one that matters.

When we look at this car in the $40K - $50K range, we can see it selling

in the range of 50K-60K per year consistently domestically even up to

80K. Yet, it will be some time before we see it hit the streets. We will

say 2017 at the earliest for our model to stay somewhat conservative

and given the delays we saw with the Model S.

In reality, we are

looking at a 2017 situation where we could see around 120K in domestic

sales, and we definitely underestimated in some of our previous models.

Let's remove that from the equation for a moment and international

growth. With 120K in domestic sales in 2017, we are looking at potential

revenue of $7.2B. The company has a goal to have margins like Porsche,

which would put them at a 15% operating margin and net margins in the

8-10% range. If the company could execute in this way, that would put

net income at 720M in the best case domestically, putting EPS at 5.90

and P/E at 26.4.

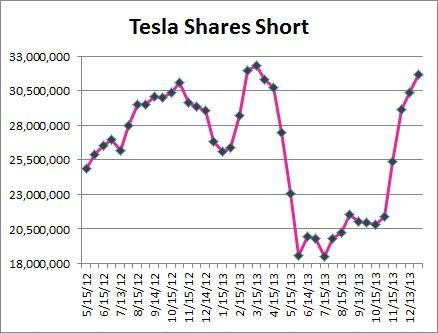

We are not high on the international side of things still with charging station issues:

Tesla

wants to meet its Supercharger charging station target in Germany by

the end of 2014. It's trying to build in a few years what traditional

car companies have spent decades doing. This gets to the heart of the

short thesis on the automaker's stock. Tesla bears say quarter after

quarter that the company is burning through cash too quickly to build

the infrastructure it wants, and make the improvements to supply chain

that it needs. Bank of America analyst John Lovallo addressed that

directly on the company's Q2 conference call, saying: "If we think about

cash flow for a minute... free cash flow was a use of about $79 million

in the quarter, and I think if you make the adjustments you guys were

talking about... $11 million for the DOE payment, a $67 million increase

in receivables that may not occur. That looks like the use of about a

million dollars. Now, you have cap ex ramping up in the back half of the

year so how are you thinking about free cash flow generation through

the remainder of the year into 2014?" Tesla CFO Deepak Ahuja could only

reply that Tesla "want[s] to be very careful about burning cash...We

want to stay as close as we can to a free cash flow position... but

that's not something we necessarily want to guide to. We're going to

manage it... and spend the cap ex where we need to to ensure we're

growing at the right pace."

There are a lot of

question marks here, so we will use two scenarios. On the low-end, we

will assume the company can grow sales internationally to 25K by 2018

and on the high-end put it at 75K. Just so you know, 200K in sales would

put the company at the global footprint of Porsche's expected 2014

sales to put things in comparison. Overall, the fact of the matter is

that demand is strong domestically for Tesla, and the product is

starting to become a household name. With the growing attraction of

electric vehicles, tax credits, lack of gas payments, and other

benefits, we have to admit we are warming up to the name a bit more.

There is still a ton of speculation, but let's get a bit deeper into pricing the stock.

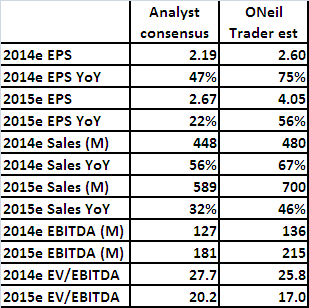

Pricing/Valuation

Revenue -

In

our model, we assume an average price point of $60K (Model S and Model X

will be higher, but the addition of the Model E will make up around 25%

of sales and have a price point in the $40K - $50K) with operating

margin at 15% (this is a best-case margin). In this scenario of 195K

models, we can see revenue at $11.7B in 2018. In our worst-case scenario

of 125K models, we can see revenue at $7.5B (along the lines of our

previous estimates).

Tax Rate -

We assume no taxes in 2014-2015 with up to 20% in 2018.

Margins -

The company has a

goal to get to Porsche-level margins,

which is around 25% gross margin, 15% operating margin, and 8-10% net

margin. That compares to a company like BMW (BMW), who has gross margins

at 20%, operating margins at 11%, and net margins at 6-7%. The company

hitting these levels would definitely put them at the top of the class.

In our best-case model, we will use 15% for operating and 12% in our

low-end model.

Other -

CapEx will grow especially with the

dedication to building out in Europe and Asia. We see at least $550M in

CapEx by 2018 and depreciation growing to around $380M. We use a cap

rate of 3%, which is very low discount rate, meaning that the company is

a high-growth name with a lot of future income pricing in and needs to

be discounted less.

In this new model (195K volume), we come up

with a price target of $195. Now, this is the absolute best case of

everything happening as we can see it now (outside of Europe). The

question mark still remains that as well as execution. In our low-end

model, we come up with a price tag of $110 in our model. In our

mid-level we are looking at $155 price tag. The difference is obviously

that we underestimated sales in the best-case scenario, and that is our

main change.

Conclusion

Speculators that believe in

this company have an argument for upside at least of 20-30% from these

levels, and that can be even higher when one considers Gen III

potential. What it comes down for Tesla is execution. The latest results

were pretty outstanding and show the company doing well with supply

chain, manufacturing, and delivery - something we questioned earlier.

This is a good sign for the company. Buyers need to understand, though,

that the company has to be perfect to see more upside. If the Model X is

not delivered in the 2H of this year, the stock will drop

significantly. If Model E does not start to show up in auto shows next

year, downside will happen. If international sales do not start to ramp

up significantly this year, downside will occur. If the company does all

of those very well, though, there is still some upside. We will admit

that we have underestimated the company and have been incorrect in our

earlier assumptions.

We are still sticking with a conservative

approach and using a $155 price tag, but we can understand the argument

for higher prices. We are not speculative investors; therefore, we will

not recommend shares to our own clients. Those that buy stocks for the

future…its very understandable to us now to get behind this name. And

yes, we were wrong in some of our earlier assessments. We did not fully

appreciate the demand as we are seeing it now.

Charting The Markets

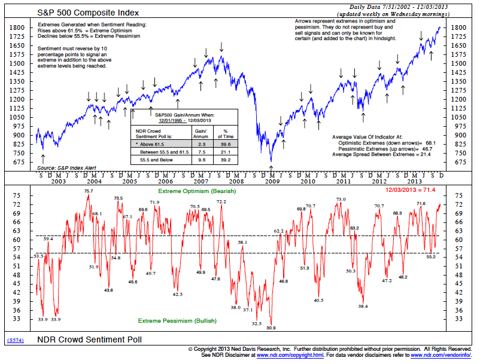

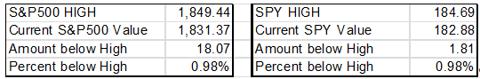

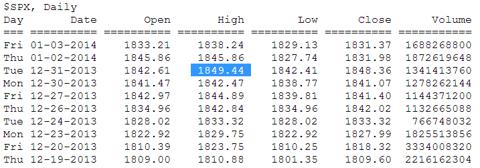

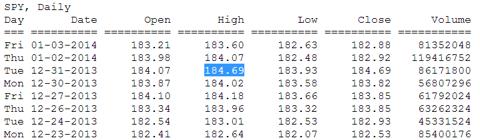

The S&P 500 (

SPY)

broke out over 1800 but has failed at the 1850 level. We also broke key

1820 support yesterday. Now, we are sitting on key 1800 support where

the 50-day MA as well as mental support sits at for the market.

(click to enlarge)

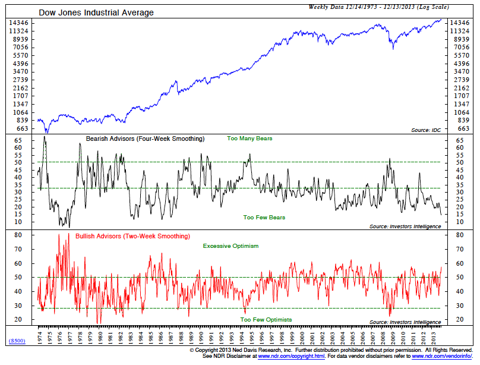

The Dow Jones (

DIA)

has resistance at 16500 right now with support sitting at 16200 along

with 16000. The key support is 16000 since its mental and the 50-day MA.

If those lines break, we don't see much support until 15700.

(click to enlarge)

Nasdaq (

QQQ)

has strong resistance above it and has failed at the 88 area. There is

support at 85 and 86 area. The index is very tight right now and should

either breakout to the upside over 88 or could retest 85 then

potentially move lower.

(click to enlarge)

Russell 2000 (

IWM)

is in a tight consolidation pattern with 116 resistance and support

just below it. If that area fails, we see good support at the 110-111

area. If it can break 116, we do not see much resistance until 118 area.

(click to enlarge) Wednesday's Outlook

Wednesday's Outlook

The

market got its much needed comeback on Tuesday, and it looks like it

could continue if things go well with earnings and data Wednesday. At

the same time, we are in a very choppy market right now. As the market

moves up and down, it will be very headline-oriented, and we do not

expect long trends to develop for a large part of the year at least not

the first half. Wednesday, the market will be watching closely for the

MBA Mortgage Index, PPI, Empire Manufacturing, and Fed Beige Book

reports. The MBA Index is interesting because of recent results showing

weak demand for mortgages that could show some housing concerns.

Additionally, we will get a key Empire Manufacturing report that is

supposed to improve from 1.0 to 3.5 for December. Finally, the Fed Beige

Book will be parsed for signs of what it means next for the Reserve.

All that comes along with earnings from Bank of America (

BAC) Wednesday morning. We are expecting a good report from them as we laid out in our weekly outlook article.

TTM

TTM

."

."