Coherent risk measure

From Wikipedia, the free encyclopedia

In the field of financial economics there are a number of ways that risk can be defined; to clarify the concept theoreticians have described a number of properties that a risk measure might or might not have. A coherent risk measure is a risk measure ρ that satisfies properties of monotonicity, sub-additivity, homogeneity, and translational invariance.

Properties

Consider a random outcome X viewed as an element of a linear space

of measurable functions, defined on an appropriate probability space. A functional

of measurable functions, defined on an appropriate probability space. A functional  →

→  is said to be coherent risk measure for

is said to be coherent risk measure for  if it satisfies the following properties:[1]

if it satisfies the following properties:[1]- Monotonicity

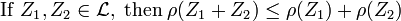

- Sub-additivity

- Positive homogeneity

- Translation invariance

No comments:

Post a Comment