Crude oil futures trim gains as U.S. dollar regains ground

© Reuters. Oil futures pare gains as U.S. dollar firms

© Reuters. Oil futures pare gains as U.S. dollar firms

On the New York Mercantile Exchange, crude oil for June delivery hit an intraday peak of $59.38 a barrel, the most since December 12, before trading at $58.69 during U.S. morning hours, up 11 cents, or 0.19%.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was up 0.15% to trade at 95.45, after hitting an overnight low of 94.48, the weakest level since February 26.

The U.S. Department of Labor said the number of individuals filing for initial jobless benefits fell by 34,000 last week to 262,000 from the previous week’s total of 296,000. Analysts had expected initial jobless claims to fall by 6,000 to 290,000 last week.

A separate report showed that manufacturing activity in the Chicago-area grew more than expected in April, following two consecutive months of contractions.

The upbeat data eased concerns over the strength of the economy and fuelled speculation that the Federal Reserve could bring forward its timetable for a U.S. rate hike.

The Federal Reserve kept interest rates on hold on Wednesday and offered little hints on the timing of its first rate hike in nearly a decade.

In its monthly policy statement on Wednesday, the Fed said it will take into account labor market conditions, inflationary pressures and expectations of international financial developments when it decides on the timing of a rate increase.

The central bank removed all calendar references on a potential window for raising rates from its statement, adding to uncertainty over the timing of a Fed rate hike.

The statement came after data on Wednesday showed that the U.S. economy grew just 0.2% in the three months to March, slowing sharply from 2.2% in the final quarter of 2014. It was the slowest rate of growth in a year.

A recent run of disappointing U.S. economic data dampened optimism over the recovery, fuelling speculation the Fed could delay hiking interest rates until late 2015, instead of tightening midyear.

A day earlier, Nymex oil prices rallied $1.52, or 2.66%, to end at $58.58 as concerns over a supply glut eased following the first crude stock draw in almost six months at the Cushing, Oklahoma, hub last week.

The U.S. Energy Information Administration said Wednesday that crude oil inventories rose by 1.9 million barrels last week, below expectations for an increase of 2.3 million barrels.

Supplies at Cushing, Oklahoma, the key delivery point for Nymex crude, fell for the first time in almost six months, dropping by 500,000 barrels to 61.7 million.

Total U.S. crude oil inventories stood at 490.9 million barrels as of last week, the most in at least 80 years, even as drilling activity fell.

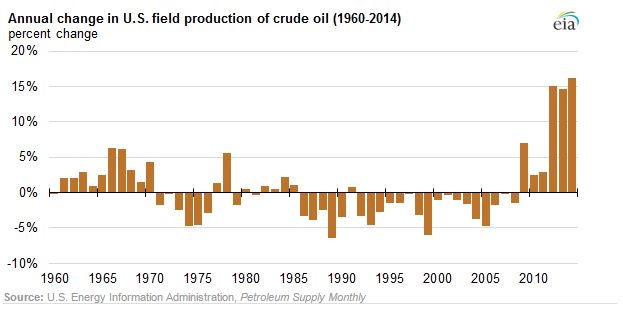

U.S. oil futures are up almost 20% in April due to mounting expectations that U.S. shale oil production has peaked and may start falling in the coming months amid an ongoing collapse in rigs drilling for oil.

According to industry research group Baker Hughes (NYSE:BHI), the number of rigs drilling for oil in the U.S. fell by 31 last week to 703, the lowest since October 2010. It was the 20th straight week of declines.

Market players have been paying close attention to the shrinking rig count in recent months for signs it will eventually reduce the glut of crude flowing into the market.

Elsewhere, on the ICE Futures Exchange in London, Brent oil for June delivery shed 3 cents, or 0.04%, to trade at $65.81 a barrel. On Wednesday, London-traded Brent futures rose to $66.72, the highest level since December 10, before closing at $65.84.

Brent futures are up more than 17% so far in April as some investors bet that a bottom had been reached after a nine-month long rout. But prices are still down approximately 43% since June, when futures climbed near $116.

Meanwhile, the spread between the Brent and the WTI crude contracts stood at $7.12 a barrel, compared to $7.26 by close of trade on Wednesday.