Summary

- Fed-induced market volatility has ramped up in the last month or so, and looks set to continue.

- The fear index is giving us a sell signal.

- Investors should be protecting profits, and aggressive traders may like to try a short position.

After the February meeting of the Federal Reserve and subsequent press conference at which they floated the June rate hike balloon, stocks bonds and commodities all declined pretty hard on the day. In the March meeting we had the reverse, with Janet Yellen indicating that the decision to raise the benchmark rate is 'data dependent' and just because they can raise the rate in June doesn't mean they actually will decide to take that action, and market confidence was mostly restored.

Central Bankers the world over are fully aware that the decision to raise rates in the U.S. will no doubt hurt the bond market and Emerging Markets too. At a press conference in India just a few days prior to the Fed meeting, IMF Chief Christine Lagarde said the following:

The danger is that vulnerabilities that build up during a period of very accommodative monetary policy can unwind suddenly when such policy is reversed, creating substantial market volatility... We already got a taste of it during the taper tantrum... I am afraid this may not be a one-off episode. This is so, because the timing of interest rate lift-off and the pace of subsequent rate increases can still surprise markets.It would appear that the Fed wants to raise rates, but are under pressure from their international colleagues not to act too hastily.

Given the February market reaction to the possibility of a US rate increase, it is fair to assume that investors in the US broad market indices fear this too. When asked on Friday about the possibility of a correction in markets, former Dallas Fed President Richard W. Fischer said:

Are we vulnerable in my personal opinion to a significant equity market correction? I do believe we are, and the reason for that is people have gotten lazy. They've depended totally on the Fed…Take the easy money punchbowl away, and it seems that investors lack the confidence to hold their long positions. Any further hint of monetary tightening this week and the 'Fed has our back' mantra is likely to change to one of 'watch your back, jack'.

Yes, we have… conditioned the markets.

This week we have already heard from one Fed board member on this topic, and with Janet Yellen speaking in San Francisco on March 27th we have the potential for more volatility and a possible decline in the S&P 500 (NYSEARCA:SPY) ahead.

Yesterday we heard from Fed Board member James Bullard, who said that he expects U.S. growth to pick up in Q2 and grow at 3%+ this year. An advocate of raising rates slowly, he said:

"Zero is no longer the appropriate interest rate for the U.S. economy."

He then went on to attempt pacification by saying that monetary policy would remain accommodative even if the Fed decided to raise rates this summer. However, you can see where this is leading.Taking an overview of our current situation, we have a Fed that wants to raise rates and has given us a warning that they could do so anytime from June onwards; we have markets that are obviously sensitive to this topic; and we have everyone else around the world fearing the ramifications of that rate increase and scrambling to position accordingly.

Markets trade in anticipation of future events, so don't expect the market to correct when the rate increase comes - it is more likely to decline in anticipation of that event and start to rally just after the official announcement makes it true.

We have palpable fear in the market place, and now we should be on the lookout for signs that the fear is justified and a correction is looming. The fear index may be warning us now that this call could be a good one.

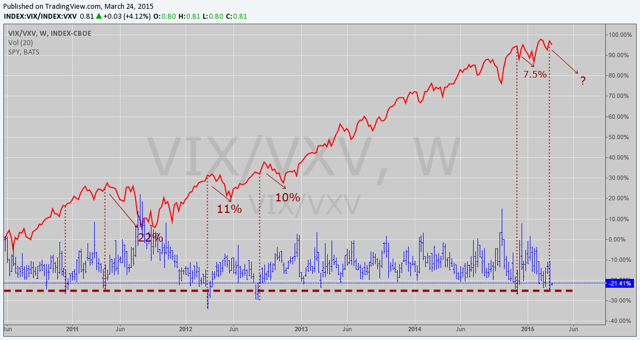

The VIX to VXV ratio is useful as it gives us perspective on how traders see the next 90 days in the market in terms of volatility. When the ratio moves lower it tells us that traders are less concerned about market volatility over the next 30 days (VIX) than market volatility over the next 90 days (VXV).

However, when the ratio moves sharply lower it often precedes a downturn in the market. In contrarian logic terms, it tells us that traders have become too complacent for the market to reward their bullish positioning.

I have marked occasions where an extreme reading was taken, and have added the S&P 500 for comparison:

(click to enlarge)

The 'extreme zone' is designated by the horizontal red dotted line, and as you can see we don't often see a reading that low. On four of the five occasions this has been seen since late 2010, it has resulted in short-term downside corrective action in the index.

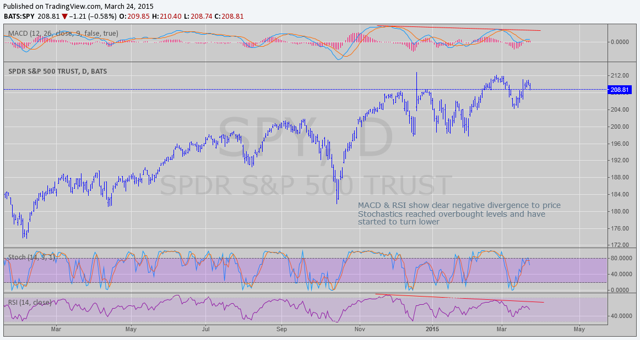

A look at the chart of the S&P 500 itself shows us that we have clear negative divergence in our technical readings, and should already be alert to danger on the long side:

(click to enlarge)

I have started small initial short positions, and will add if we go a little higher and/or if we break initial support. Should the downside projection start to play out I will also look to open a long position in VIX.

I wish you good luck for the coming week!

1 comment:

Just received a payment for $500.

Many times people don't believe me when I tell them about how much money you can earn taking paid surveys at home...

So I took a video of myself actually getting paid $500 for taking paid surveys.

Post a Comment