Summary

- Vipshop Holdings Reported Staggering Q1 Earnings That Exceeded Analyst Expectations.

- The Effect Of The LeFeng Acquisition Will Likely Be Seen By 2014Q4 At The Earliest, But Should Prove To Be A Very Shrewd Acquisition.

- The Company Stands To Benefit Further From A Blossoming Chinese Ecommerce Market.

Introduction

Vipshop Holdings (VIPS) has seen tremendous growth in its equity value since its IPO in March 2012, with the stock price rising a staggering 2660%. Because of this, Vipshop has garnered a lot of attention from investors, particularly as investor appetite for Chinese companies has been waning since the end of Q1. In addition, on May 15th, the firm reported another set of stellar results, beating analysts' expectations on the top and bottom line.In light of last week's earnings release and the plethora of Chinese ecommerce firms listing in the US this year, this article will discuss Vipshop's outlook and its operations in China.

The Business Model

Vipshop offers genuine brands at large discounts for a limited time period, and their user base has grown to 28 million in just 4 years. The customer base is currently predominantly female, with only 25% of customers being male. The company has about 9900 brands, where the top 20 suppliers account for about 12% of revenue, and the top 10 account for less than 10% of total net revenue.

Many investors have been under the impression that the majority of the revenue comes from tier 3 and 4 cities. However, the revenue from tier 1 and 2 combined is actually larger than the tier 3 and 4 combined revenue. Tier 1 cities represent 12% of revenue, whilst tier 2 represents 40%. This is important, because Vipshop caters for the whole of China, rather than just a particular set of customers. It allows Vipshop to take advantage of the whole boom in the Chinese ecommerce market, rather than just a particularly segment.

In 2014, Vipshop will focus on reducing expenses by expanding warehouse capability. This will also help to improve their ability to serve their customers. At the end of Q4, the company's warehousing capacity reached 350,000 square meters, and is on track to expand over 700,000 square meters by 2016, after a $200m investment. The company will also have its first fully-owned warehouse up and running by the end of 2014.

The company is committed to growing their product portfolio both organically and through acquisitions. Cosmetics is a key element, and this was shown by the company's acquisition of LeFeng.

The Acquisition Of LeFeng

On February 14th 2014, Vipshop completed the acquisition of Chinese online cosmetics retailer LeFeng.com, as part of its strategy to diversify its product portfolio into the profitable Chinese cosmetics retail industry.Of the total active customers from Q1 of 7.4m, about 1m actually came from LeFeng, which generated 1.3m orders. Analysts have discussed the effect of LeFeng on the average order size, because in Q1 the average ticket size actually decreased. However, as CFO Yang Donghao explained, cosmetic customers' orders tend to have a lower dollar amount.

The traditional average orders per customer for Vipshop is about 3x a quarter, which is significantly more than the 1.3x from LeFeng customers. It remains to be seen whether this is a continuing trend, as the LeFeng acquisition wasn't officially closed until mid-February, so the 1.3x figure could improve in the second quarter. Yet Vipshop plans to address this primarily by improving operational capabilities, as cosmetics customers do tend to order less than other customers.

In addition, the revenue contribution from LeFeng in Q1 was less than 5%, although this can be attributed to the deal being closed on 14th February. Although investors will likely have to wait until the end of the year to begin to see the full effects of the acquisition on Vipshop, the combined cosmetics GMV of both firms is $167m, which makes it the second largest player in the market, and ascension to first place is targeted in the near future.

CFO Yang Donghao discussed how the revenue generated by LeFeng isn't currently meaningful to the overall company, as it's still small. In fact, LeFeng isn't growing as fast as Vipshop's core business of apparel. But the intention is that LeFeng will grow and catch up with the rest of Vipshop, as soon as it has been fully integrated with Vipshop. LeFeng and Vipshop currently have two independent websites and systems, which makes cross selling difficult. Whilst it's not a top priority at the moment, the cross selling strategy will develop.

Exposure To The Chinese Ecommerce Industry

As with most Chinese ecommerce firms listed in the US, Vipshop operates almost completely within China.The Chinese ecommerce market is already larger than the US, in terms of size and retail as a percentage of total consumption. One of the main reasons for this is the lack of brick and mortar infrastructure to rival online retail. For example, in the US, huge superstores have been the backbone of the retail industry for decades, with the likes of Walmart being able to offer a wide variety of goods to customers. However, China doesn't have this infrastructure, particularly away from the Tier 1 cities. So out of a lack of feasible alternatives, Chinese ecommerce has boomed.

But as the industry has boomed, it has also evolved in such a way that a brick and mortar alternative is unnecessary. For example, goods ordered online will almost certainly arrive the next day, and in most cases the delivery charge will be minimal, if not free. This is because of the logistics system in China, where it's common to see deliverymen on electric scooters with seemingly far too many parcels balanced precariously on the parcel rack, whilst weaving in and out of traffic. Yet this logistics system works, because every single mile is stretched so that packages can be delivered quickly. And when you compare this to the US, Amazon charges for $99 annually for unlimited two day shipping, which explains the reason why the ecommerce industry has boomed, and will continue to grow. Users have a huge selection of goods that are delivered within 24 hours in a cost effective manner.

The initial boom in the industry began as a customer to customer, C2C, platform model, where the likes of Alibaba would provide buyers and small vendors with an online platform in which to trade. However, as Chinese consumer tastes have evolved, the rise of business to consumer, B2C, platform models has taken place. One of the main reasons for this is because the C2C model offers no guarantee of the quality of goods, and is plagued with fake goods. However, the B2C model connects consumers with the actual brand, and hence doesn't have these worries. This has created opportunities for the likes of Vipshop, JD.com and the Tmall branch of Alibaba.

In the US, when Amazon was first launched, the B2C model was already well established, in the brick and mortar sense, because companies would rent physical real estate to sell their goods directly to customers. Therefore, because customers were already used to the B2C model, the Amazon platform was easily accepted by consumers. In China, the Taobao C2C was scalable, and easily accepted by consumers. In fact, you can walk into most shopping malls in China, and still see that the first two floors are brand name shops, and the upper floors are small vendors.

This can explain the huge growth seen in the platform model in China, because the likes of Taobao and Tmall have such a dominant share of the market, that as Chinese consumers' tastes develop and they want brand named goods, these brand name firms can't enter the market directly, so they have to rent the virtual real space on the likes of Tmall and JD.com.

In the most recent analysis of the ecommerce market by McKinsey China, they discussed the future of the ecommerce industry here in China. The major firms are focusing on the O2O model, online to offline. They do this by letting users pay for goods using the WeChat app, and use mobile promotions to attract customers to come to the physical store. Also, as we have seen with Alibaba's $300m acquisition of department store operator InTime, Alibaba will allow customers to use AliPay on their mobile phone to purchase goods in store, which would increase brand loyalty and additional purchases.

However, in the US, we wouldn't see that. Amazon wouldn't acquire retail space, and in fact, in Best Buy's earnings report, they announced a gross profit margin that fell less than expected, because the firm has been using its physical stores as mini distribution hubs for processing shipments and orders, and is now able to ship from all of its 1,400 retail stores. Retailers focus on this because of the trend of 'showrooming', where customers use the physical stores to view the product, and then buy online.

From A Valuation Perspective

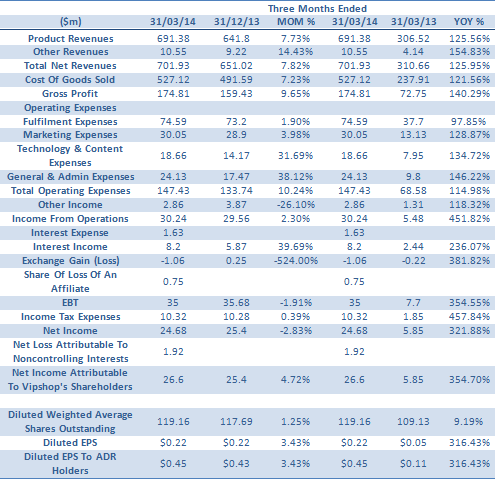

Vipshop had another stellar quarter, reporting record net revenues of $701.93m. This was an increase of 125.95% YOY, which even for Vipshop's own high standards, is impressive. This was primarily due to a 165.1% increase in active customers from 2.8m to 7.4m, and a 129.3% increase in total orders from 8.8m to 20.2m. Year on year, gross margin increased from 23.4% to 24.9%.

The acquisition of cosmetics retailer Lefeng.com is expected to generate synergies via cross selling, using both platforms to streamline cosmetic offerings, and by lower combined expenses. Vipshop has already been investing in warehouse expansion, in cooperation with LeFeng operations.

Vipshop also issued new guidance for the second quarter revenue to be between $780m and $790m, which would represent a YOY growth rate of between 122% and 124.9%.

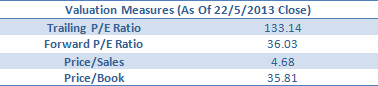

The trailing 12 months P/E ratio is 133.14, which is high relative to most in the industry, but the forward P/E ratio drops to 36.03. Likewise, the P/S ratio for 2014 and 2015 estimates is 2.87x and 1.85x respectively. Given that revenue since 31st Dec 2011 has grown at a CAGR of 173%, these P/S ratios seem very cheap.

The company has 1.95m shares short, as of the 30th April, which is a ratio of about 8% of the 24.86m float. This is somewhat understandable given the exponential rise in its stock price since its IPO, however, Vipshop's earnings continue to beat estimates.

The company saw improving gross margins this quarter, which was due to the growing economies of scale. The fast growing revenue has given the firm greater bargaining power with suppliers. In the Q1 conference call, CFO Yang Donghao highlighted the number of sales events that the company held during the quarter, with the 14,200 events exceeding the 14,000 from the previous quarter and increasing 63.4 from a year before.

Looking Ahead

The company is focusing on three areas of development for the future: extending the consumer base, improving the customer shopping experience, and using technology and mobile to drive more business.The company is looking at expanding their product portfolio, outside of their core categories, and this has included testing of an auto flash sales model, in which Vipshop would offer discounts on buying cars for a limited time. One of the main reasons for this is because the majority of Vipshop's customers are female, and an auto flash sales category would attract more men to the site.

CEO Eric Shen has commented that the firm is making strides to migrate their services onto mobile platforms. As discussed earlier, the Chinese ecommerce industry as a whole is moving towards mobile platforms, and it's important for Vipshop to maintain the pace within the industry.

On 11th March 2014, the company priced a follow on ADR and convertible senior offering that raised over $632m. This capital was used to fund the acquisition of cosmetics firm LeFeng, and to fund future growth initiatives. This is particularly interesting because Vipshop is seemingly at a stage where it can afford to grow and diversify its operations through acquisitions. CEO Eric Shen discussed that any acquisitions would be to supplement their core customers, in order to attract more loyal and sticky customers to the company.

The company has invested a lot into the IT department, where the current number of 860 staff is expected to almost double to 1500 by the end of the year. This will help to launch the company's focus on personalised recommendations and customer profiling. In Q2, they have already begun testing different interfaces for male and female customers, based on previous purchase and browsing history. This is intended to increase customer retention and the customer purchase rate.

Vipshop has migrated to a mobile platform via the wildly popular WeChat application. This is an important step for Vipshop because WeChat has the technology that allows customers to pay for items via their WeChat account. This has only just been released by Vipshop, but it certainly has a lot of potential. In Q1, mobile trends contributed 36% of revenue, and in April alone, it reached 43.6%.

Summary

It's unusual to think that a stock that has risen 2660% in 2 years could still be highly regarded by analysts, but Vipshop is one of those rare exceptions. From a financial point of view, it continues to see staggering growth across all key metrics, and management is raising guidance for the following quarter.From an industrial point of view, the Chinese ecommerce market continues to grow, and as the middle class gets wealthier and more numerous, it will drive the industry. In addition, the Chinese government is committed to developing transport infrastructure networks from the affluent eastern coast to inland China. This should increase online retail revenue from the tier 3 and 4 cities.

Finally, from a future outlook point of view, Vipshop is making the right acquisition moves to develop and diversify its product portfolio, and is keeping up with the industry trends by migrating to a mobile platform. As it grows both organically and through acquisitions, investors will start to see Vipshop taking market share away from competitors JD.com and Tmall.

No comments:

Post a Comment