2012 marked a monumental year in regards to housing and the economic recovery. Unemployment declined, the economy began to stabilize, and consumers were more confident about their financial future. As 2013 begins, many investors are still somewhat leery about investing in the housing sector. My aim, through this article, is to provide a compelling reason why housing is poised for a robust recovery for years to come. I will then offer my suggestions as to which stocks are well positioned to take advantage of this recovery.

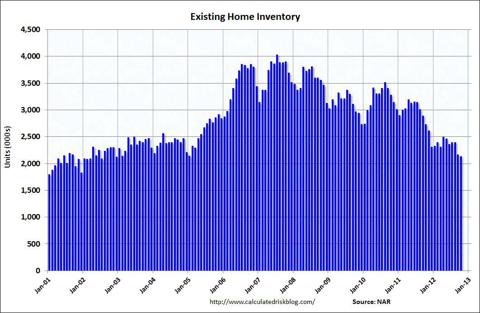

To begin, the major question prevailing in the market is whether home prices will continue to decline? So far in 2013, the answer seems to be "no." Housing inventory has fallen roughly 44% from its peak level in early 2010. As indicated by the chart below, inventory continues its slow and tepid decline. Very methodically, the available housing inventory in America is being purchased.

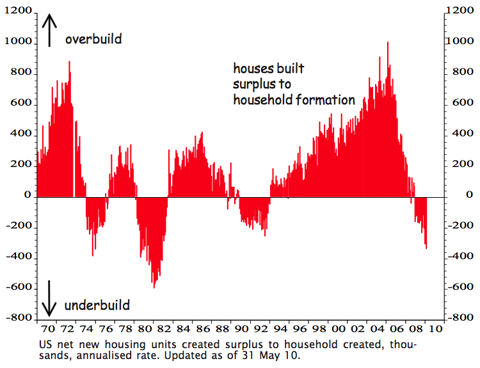

This decline in housing inventory is important for two reasons. First, the oversupply occurring in the early 2000s is being corrected by natural means as consumers continue the deleveraging process. The chart below presents the mass housing optimism prevailing prior to 2008. During its peak, America was producing nearly 800,000 more houses than it needed. This surplus was a direct result of very loose underwriting standards, combined with mass consumer optimism regarding the housing sector overall. As such, individuals who otherwise couldn't afford homes, entered into the market. The subprime market was particularly prominent in the years 2001 to 2007. As such, the housing sector must first correct this oversupply in an effort to create housing demand and subsequent rising prices.

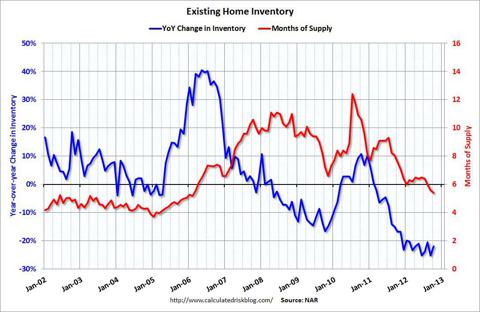

Second, there is now a viable market of both buyers and sellers within the housing sector. These influences will tend to stabilize prices as investors are now more willing to purchase homes for the long term. The following chart shows year-over-year changes in housing inventory. The trend continues to move downward as the available inventory in the market is being bought. The oversupply in the chart above correlates with the heightened inventory levels prevailing in the market. The decline in inventory levels may also indicate that sellers believe the market has reached a bottom. Sellers, believing they can now wait for a more robust recovery, do not list homes that are otherwise for sale. They elect instead to wait for an impending upturn in demand or a subsequent increase in prices.

The opposite is true when sellers believe prices will fall. In this instance, sellers rush to the market to sell their homes at the best available price, to avoid selling at even lower prices. This reaction creates massive increases in inventory, much like what was realized in 2007. As inventory continues to decline however, I would expect demand for housing to rise. This upturn in demand will subsequently create a rise in housing prices overall.

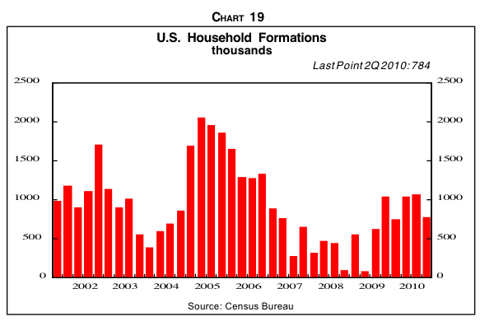

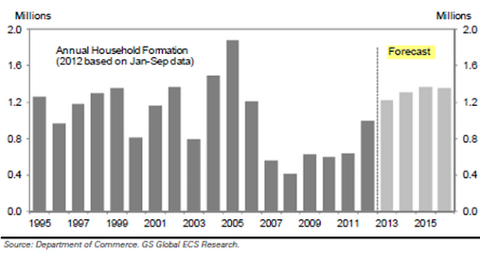

How is this demand for housing going to come about? Well, to answer that question, an investor must know how many households are being formed. The chart below shows household formation from 2002 to 2011. Notice that each year since 2008, household formation increased. This is important as the household formation increase correspond directly with the housing inventory decreases mentioned earlier. As consumers continue to form households, they naturally will demand housing. This trend has been occurring slowly since 2009.

(click to enlarge)

Household formation, is being postponed due primarily to various economic circumstances prevailing today. The tepid jobs market, combined with economic uncertainty has made consumers hesitant to form households. However, as the jobs market and economy continue to improve, so too will the prospects for household formation. Below is a chart from the Department of Commerce, indicating the forecast growth of households. Notice that the forecast indicates continued growth in household formation. This continued growth in household formation is occurring simultaneously with the decrease in available inventory. Over time, I believe the continued growth in household formation will overtake the available inventory within the market.

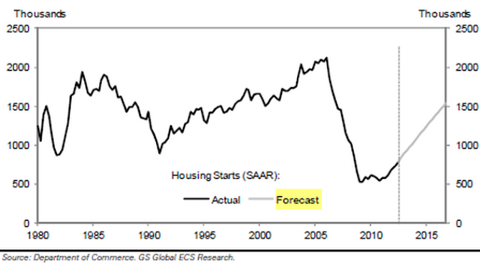

Once household formation and available inventory reach an equilibrium point, the oversupply of housing will be completely eroded. When this occurs, consumers will demand more housing as they continue to form households. This demand, I believe, will ultimately drive new home construction for years to come. My theory has already been proven correct as household starts are continuing to rise. Below is chart indicating current and forecast household starts. Notice the continued uptrend since 2008.

Given this information, there are two sectors that I believe show considerable promise to rise in value for the long term. These sectors are housing and financials. In regards to housing, as I have already indicated, available inventory is shrinking each month. Likewise, unemployment is continuing its steady, albeit slow decline. Investors, and society in general are becoming more confident regarding their fiscal matters. Consumers, particularly those hardest hit by the financial crisis are getting their personal balance sheets in order. These consumers are paying down debt and increasing their savings. These circumstances translate directly into the housing and financial sectors. I recently read an FDIC report, which shows rapid deposit growth in many of the large financial institutions such as Wells Fargo (WFC) and JP Morgan (JPM). These deposits, due primarily to low interest rates, will at some point be deployed in higher yielding assets. Due to the very low mortgage rates currently prevailing, I believe a substantial portion of these assets will be deployed in housing related aspects. As such I believe ETFs such as KBE,ITB, and XHB show considerable promise. ETFs such as XLF, IFGL andVNQI, also show promise to increase in value.

In addition, household formation is continuing to grow, again, at a very slow rate. In many markets it is now cheaper to own a home than it is to rent one. Home prices in many of the areas hardest hit by the recession are beginning to rise. Areas such as Nevada, Miami, Arizona, and Phoenix, are showing considerable signs of improvement. The lower available inventory combined with the increased affordability and household formation will allow the housing market to reach equilibrium. After this equilibrium has been reached, consumers will demand houses, further exacerbating construction overall. All of these factors, I believe, create a very compelling argument for the long-term rise in many of the housing and financial assets mentioned above.