Summary

- Defying all the experts, even the bullish ones, the S&P 500 has resumed hitting new highs in June.

- The P/E and its reciprocal E/P appear to show an over-valued market.

- However, after adjusting for the current interest rate environment, the P/E and E/P show a market with plenty of value left.

The technical situation is without a doubt very bullish at the moment, but it's the valuation of the US market that has caused a general distrust for this bull among pundits. They argue that on virtually any metric, the market is either fairly valued or overvalued. If this is the case, below average returns should be expected in the near to medium term.

With the SP500 (SPY) at a lofty 1950 at the time of the writing of this article, the trailing P/E (using trailing 4Q earnings) is sitting at 19.35 while the forward using 2014 earnings estimates is at 17.05. The CAPE is showing even worse, over-valuation coming in at 25.89. These are all showing a market that is overvalued based on historical averages of these metrics.

While there is no arguing that these metrics are elevated, the bullish case argues that they may miss valid shifts in the economy that justify higher metric values. This is a very hard case to make and even harder to verify for most of the arguments, except for one. The interest rate environment currently is very different from any we have seen in the US since the great depression and this fact can be easily measured and defined in terms of 10yr treasury yields.

It would make sense that investors have to make a choice about where to put their money in order to generate an acceptable rate of return on their capital. In a lower interest rate environment, they may require less return on capital from equity investments than would otherwise be the case. The longer they expect this environment to persist, the lower the required rate of return on perpetuities such as equities would logically be. Anyone with even a basic understanding of discounted cash flows would then expect the price to immediately adjust upwards, as these expectations take hold, and therefore permanently drive up the P/E ratio (or until expectations change). The question then becomes what is an appropriate or fairly valued P/E ratio for the current interest rate environment.

I am a big believer that the simplest metrics are generally the best metrics so I like keeping things simple. The P/E ratio can be inverted to arrive at an earnings yield, which gives us a proxy for return on capital to the investor, while the 10yr treasury rate is a good proxy for the interest rate environment. Subtracting the 10yr treasury rate from the earnings yield (E/P) gives us the excess earnings yield to an investor above what they can expect from a risk-free investment (also called the risk premium). This gives us a simple valuation metric that is adjusted for the interest rate environment.

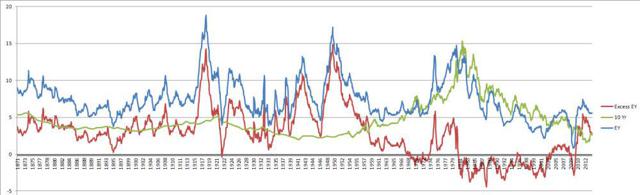

The chart below is based on the trailing earnings yield realized on the SP500 over the past 142 years ending at the end of 2013.

Excess EY based on trailing earnings - 1871 to 2013

(click to enlarge)

The first thing that's obvious from the chart above is that we are actually solidly above the 0 line and equities are generating earnings at the largest premium over 10 yr bonds since 1980. The second perhaps less comforting observation is that it appears there was a large structural shift of some sort starting in the 1950s driving the excess EY down below historical averages. The first observation leads us to evaluate the market as being a good bargain at current prices and interest rates. The second observation calls into question the last 50 years as an anomaly.

Regarding the second point, I have once again a simplistic answer but one that seems to me more likely than the alternative explanations. If there is an anomaly in this chart, I believe it is the period from 1915 to 1950, a period of two world wars and a major shift in geo-political and financial power from Europe to the US. Following 1950, the emergence of the dollar as the world's reserve currency and the stability of the US itself, compared to other regions in the world, could explain the shift to permanently lower excess earnings yields. This is by no means a well researched explanation, so I offer it more as a food for thought than anything else. However, while excess EY did become lower than ever after 1950, this post-war period still bears more similarity to pre-1915 than to the world war period.

Regardless, now that we have a long enough time series, the excess earnings yield can be used to arrive at a reasonable stock market valuation, and we are going to use the entire time series including 1915-1950.

The average excess EY since 1871 has been 2.82% while the current 10yr rate is sitting at 2.6%, which implies a fair value E/P of 5.42% or a 18.45 trailing P/E. Assuming no change in the interest rate and 2014 earnings estimates being exactly correct, the E should come in at 114 for 2014 and the end-of-2014 fair value for the SP500 should be 114*18.45 = 2103.

I completely agree that the two above assumptions of earnings coming in on target and interest rates staying the same may be unrealistic. The point of this analysis is less to give an exact estimate and more to put the current SP500 value in perspective. Even if we assume interest rates going up to 3% and earnings coming in at 5% below estimates at worst, we are looking at no returns until the end of the year. This is assuming the excess EY cannot go below the average, which is a stretch given that the post-World War II average has been significantly lower.

Currently, the US market does not appear to be overvalued if the current interest rate environment is taken into account. It appears to be somewhat under-valued and I believe still offers good value from a historical perspective. This may explain why it keeps moving higher despite all the negative press and daily warnings of imminent disaster.

Click here to search for SPY options that will generate a profit by December 20th, 2014 given an 7 percent rally (SP500 at approximately 2085).

Additional disclosure: I am long SPY call options and not SPY directly. This significantly reduces my exposure to adverse market events.

No comments:

Post a Comment