Sentiment is analogous to popular opinion. As investors, we are constantly looking to create an edge in the markets. When popular opinion sways too far in a particular direction, it creates a highly correlated market that makes it difficult for portfolio managers to produce alpha over benchmarks. This situation typically occurs directly preceding the end of a large market run. During such a cycle, managers tend to move into higher beta securities in order to help correct their performance deficiency. Toward the end of a run, everyone is optimistic and all fear has been wrung out of the markets. Such is our current predicament. This month’s issue will delve deeply into the problematic sentiment issue.

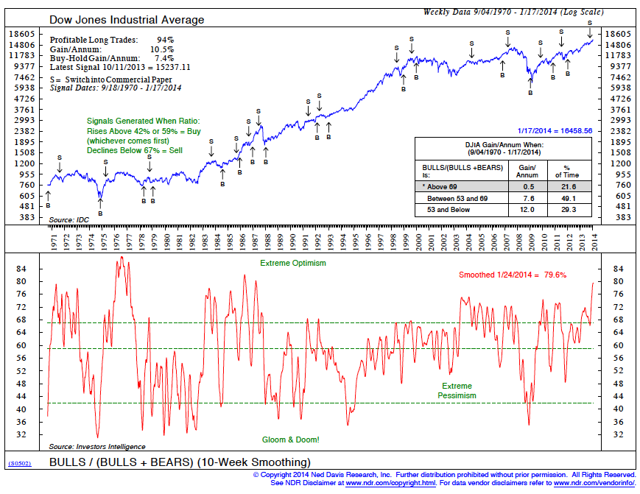

Chartcraft is currently the “keeper” of bulls/bears data. However the late Marty Zweig created a twist known as the Bulls/Bulls+Bears. The current reading on this indicator is 80.3, which is exceedingly bearish. A level this excessive has not been seen in 27 years. In fact, such an optimistic number was not even reached in 2000.

click all images to enlarge

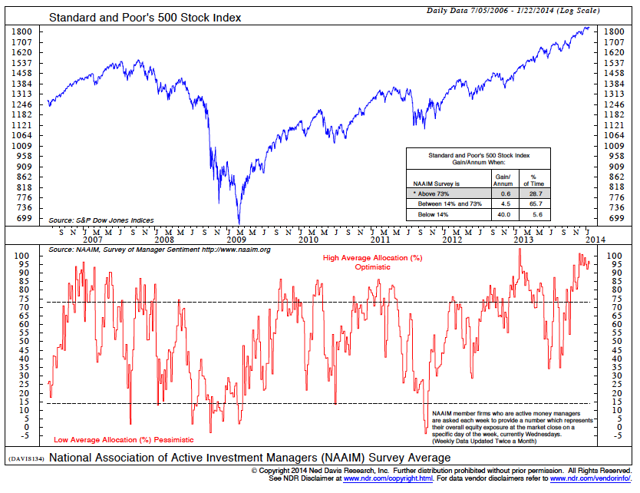

The NAAIM Survey Average is a sentiment gauge that polls active investment advisors each week and determines the equity exposure of its members. Exposure can range anywhere from 50% short to 150% long. The current reading of 95 is within the top few percentiles of the gauge’s 8-year history. Such high exposure is a good indication that the market is over-owned.

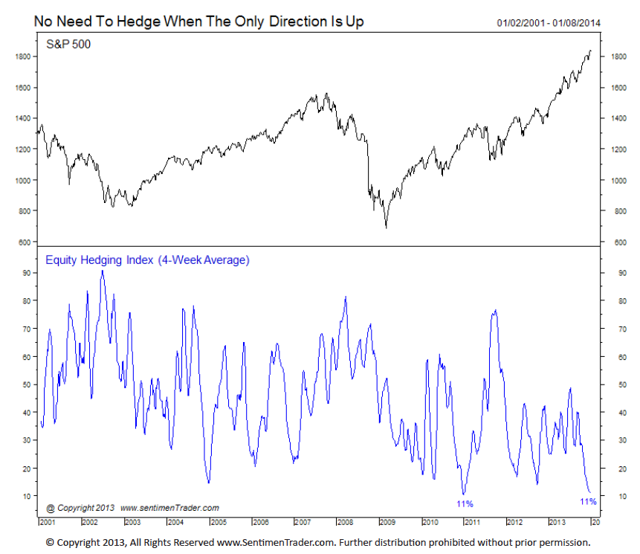

Jason at sentimenTrader.com has created a useful indicator called the Equity Hedging Index (EHI), which takes into account various ways that most speculators hedge against a market decline. There are six components to this index:

1. Raise cash

2. Buy put options

3. Buy an inverse ETF

4. Buy an inverse mutual fund

5. Sell short futures contracts

6. Buy credit default swaps

The EHI looks at each measure listed above and compares them to historical averages. When this index reaches high levels it indicates that significant hedging is occurring. Conversely when the index dives to lower levels it indicates that very little hedging is going on. We are currently at a 13-year low in this indicator, which shows that the type of hedging that was happening in 2008 is a distant memory.

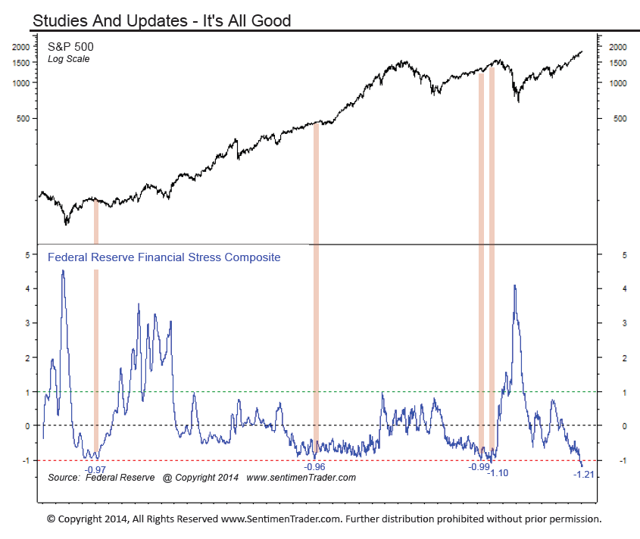

Another recent study produced by sentimenTrader.com analyzes the Federal Reserve Stress Composite, which is comprised of the following:

1. Cleveland Financial Stress Index

2. Chicago Fed Financial Conditions Index

3. St. Louis Fed Financial Stress Index

4. Kansas City Fed Financial Stress Index

These four indexes are all quite similar. They focus on stock prices, volatility, interest rates, liquidity demands, etc. When the composite reaches -1, it indicates that there is little if any stress in the economy. However when it moves closer to +1, stress in the system is present. The Federal Reserve Stress Composite has just hit a 40+ year low, indicating that the environment is incredibly complacent. Of the 70 days that it has traded below -1, the S&P 500 has had a median return of -6.4%.

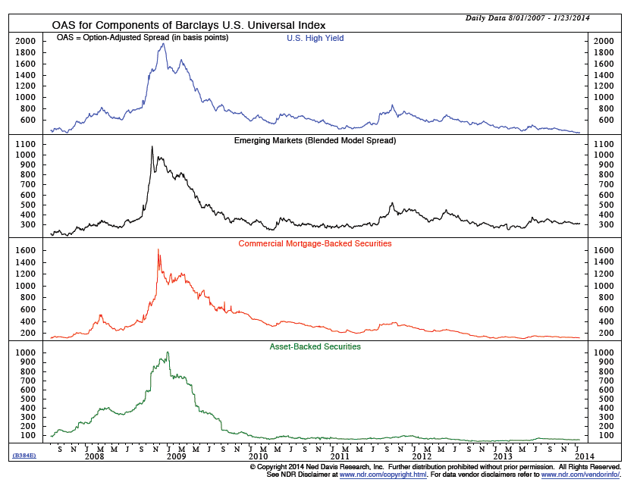

Historically, credit spreads have widened during stressful financial periods and tightened when the economy is running smoothly. They can serve as a good sentiment indicator, especially at extremes. Current credit spreads are trading at 30-year lows; implying that corporate and government credits are at parity. This is alarming because it indicates that the marketplace is “chasing yield” and is not fearful of losing principal.

The emerging markets are clearly breaking down. Here is a relative performance chart that takes S&P 500 performance and divides it by the emerging markets index. Over the past three years the S&P index has dramatically outperformed the emerging markets index. Since we count in emerging markets to serve as the world’s growth engine, this negative divergence is worrisome. With emerging markets having already entered a bear market, it is likely that the weakness will spread into all indexes.

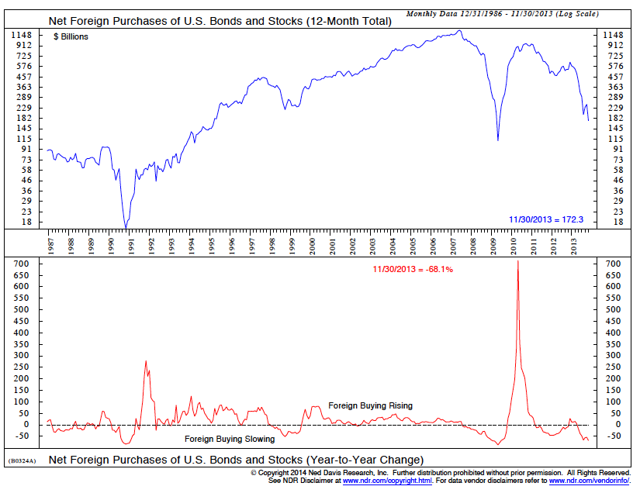

According to the latest report from the U.S. Treasury, foreigners are losing interest in U.S. securities. The current data indicates that foreigners sold $11.4 billion in bonds and stocks in November. The 12-month average is now down to $14.4 billion, which is the third lowest reading since Q1 1995. While foreign investors were strong supporters of U.S. securities from 2009 through 2012, they were net sellers of stocks in 2013. This is definitely a warning sign as continued selling of U.S. securities could put downward pressure on prices in 2014.

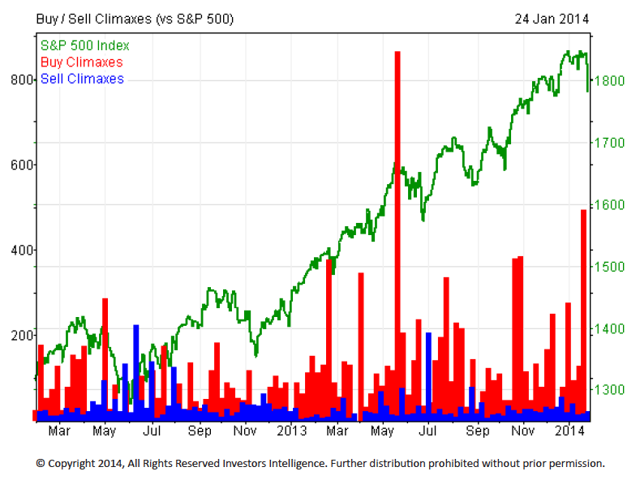

This chart provided by Investors Intelligence, displays Buy/Sell climaxes. A buying climax takes place when a stock makes a 12-month high yet closes the week with a loss. Heavy buying climaxes have been occurring frequently during the past year. This activity indicates distribution in the marketplace, which is bearish.

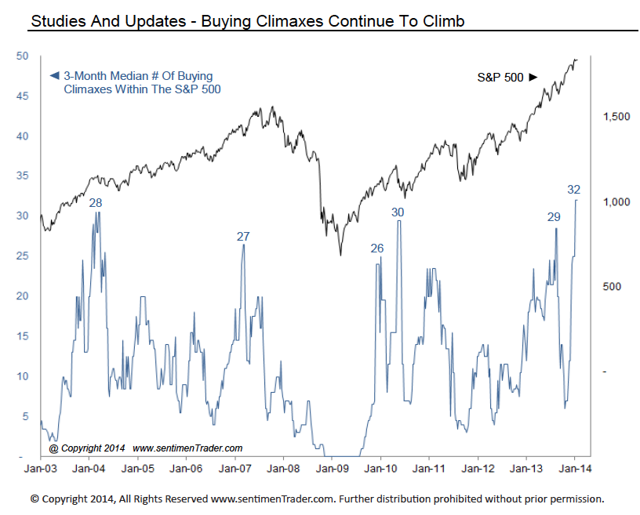

Another buying climax tool has been created by sentimenTrader.com. This particular chart solely gauges the 3-month rolling average of S&P 500 buying climaxes. This data supports the Investors Intelligence information displayed in the preceding chart.

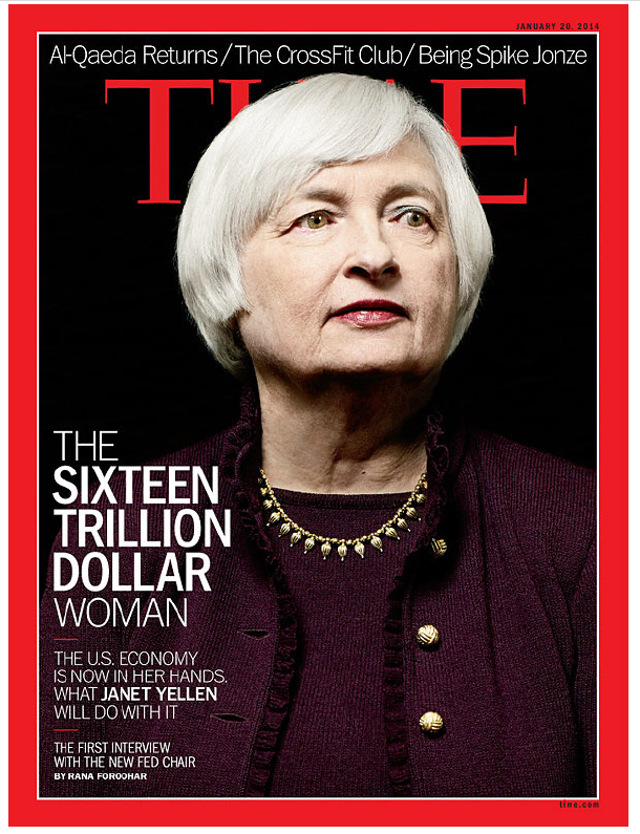

We end this issue with yet another magazine cover devoted to finance. Time magazine can select anything they wish for their cover stories, yet for the January issue they chose to highlight Janet Yellen. This is another bearish sign for the market because it shows that mainstream media is overly excited about the rally.

Conclusion

Being a growling bear can be quite tiresome. However, the indicators we monitor are failing to signal any positive news. The market is overvalued, over-owned and extremely over-optimistic. Therefore, we are maintaining our 32.5% short position.Disclaimer

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential.

Disclosure: None

No comments:

Post a Comment