Summary

- Solar City is Elon Musk's other company.

- I love a recurring revenue model like Solar City.

- Why I own Tesla and Solar City.

My Money is on Elon Musk

I was recently asked by one of my radio listeners about my opinion of investing in Carl Icahn through his Icahn Enterprises (IEP). My reply was, you can invest in Icahn or a real innovator like Elon Musk.

I recently published an article on Tesla (TSLA), the shiny red stock that Mr. Musk is behind. I have a five year target price on that stock of $465. To see how I arrive at that seemingly outrageous number, click here.

Today, I want to feature one of Elon's other ventures.

SolarCity Corporation (SCTY) was founded in 2006 and is based in San Mateo, California. It has only been trading publicly however, since December 2012. The company is engaged in the design, installation and sale or lease of solar energy systems to residential and commercial customers and government entities in 14 states.

SolarCity's CEO Lyndon Rive, is famed serial entrepreneur Elon Musk's cousin. Elon Musk, the CEO and Chairman of Tesla Motors and the founder and CEO of SpaceX, is also the Chairman of SolarCity and actively involved with the company. This linkage is particularly significant given the potential business synergies between SolarCity and Tesla Motors.

SolarCity offers investors an attractive way to invest in the growing solar industry. Since the company does not manufacture its own solar panels, its financial results are not negatively impacted by declining solar panel prices and margin pressure.

SolarCity sells solar panel systems to residential and commercial customers, but the bulk of its business comes from the leasing side. SolarCity will generally install a system for free in exchange for a 20-year lease contract. I love recurring revenue models.

Leasing Model

The leasing model creates upfront costs for SolarCity in the short-term, but creates a reliable future income stream as the number of solar installations continues to increase. From the customer perspective, there is no upfront cost of installation, which facilitates a simple switch to solar.

Instead of paying their utility company monthly, the customer pays their solar lease bill which is typically lower. The customer receives clean, more affordable energy. The lease contract is also transferable upon moving. A win-win for all involved.

The value proposition from SolarCity's perspective is that they have a consistent, predictable stream of 20-year cash flows. The economics also improve from decreasing cost of capital and all-in installation costs as well as higher utility rates. SolarCity also has the opportunity to upsell other energy services to its customer base.

Solar Industry Growth

In the period from 2010 to 2012, the solar industry saw the pace of installations grow 670%. 2013 marked the first year that U.S. installations surpassed the world leader, Germany, with more than 400,000 individual solar projects installed last year. Fueling much of this growth is backlash over net metering, government incentives and tax credits, and reduction of cost and connection obstacles.

The state of California more than doubled its rooftop installations in 2013 from 1000 to 2000 MW. To put the significance of this number in perspective, it took California over 30 years to build its first 1000 MW of rooftop solar, and it just doubled it in one year.

Gaining Market Share and Scale

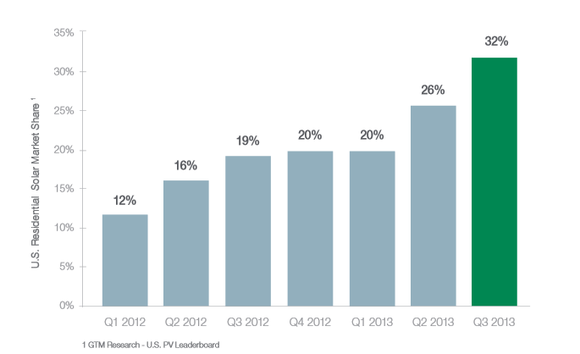

SolarCity's competitive leasing model is helping the company gain market share. The company's share of the market has risen to 32% from 19% a year ago. Given the fragmented nature of the solar installation business, SolarCity's 32% market share was the equivalent of the next 14 competitors combined.

Source: SolarCity Investor Relations

SolarCity deployed 280 MW (megawatts) of capacity in 2013, which exceeded the company's initial guidance of 250 MW. Total MW deployed was up 116% year over year, driven by strong residential growth of 130% year over year. The company expects 475-525 MW to be deployed in 2014, which would represent an increase of almost 80%.

Due to the long-term nature of the company's lease contracts, company management relies on specific metrics to gauge new sales activity and its business outlook. Operating highlights from 4Q2013 include:

- Estimated Nominal Contracted Payments Remaining increased to almost $2 billion at December 31, 2013, up 79% year-over-year and 15% since the end of the third quarter of 2013.

- Retained Value forecast increased to $1.05 billion at December 31, 2013, equating to retained value per watt forecast of $1.51/W at December 31, 2013.

- Undeployed Tax Equity Financing Capacity of 171 MW as of February 21, 2014.

The company's cash flow turned positive in 4Q 2013, and the company's guidance was that it would remain cash flow positive in 2014. Economies of scale have been driving down cost per watt as volumes track ahead of target. In 2013, the company reduced cost per watt by 30%. Project cycle times have also been coming down, which equates to fewer labor hours spent during installation.

Source: SolarCity Investor Relations

Sales Strategy

SolarCity employs a diversified sales strategy in order to drive new customer growth. Its sales strategy uses a combination of direct sales (phone, internet/email, radio, direct mail, door-to-door) customer referrals and partner referrals. SolarCity's extensive network of referral partners includes homebuilders Pulte (PHM), Shea, and Taylor Morrison (TMHC); retailer Home Depot (HD); and auto companies Tesla and Honda (HMC).

DemandLogic and the Tesla Gigafactory

Elon Musk views SolarCity's and Tesla's businesses as interconnected. Last December, SolarCity announced a new program called DemandLogic that would provide large batteries to businesses to help them lower peak demand rates. The program couples solar panel installation with refrigerator-sized batteries that store up to a third of the solar power. Specialized software can then be programmed to take advantage of that stored electricity during times of peak demand.

Next comes the Tesla Gigafactory, an enormous battery manufacturing facility which will produce lower cost batteries. Lower cost batteries increase the value proposition of SolarCity's DemandLogic offering and give it a competitive advantage. Basically, any battery product breakthroughs that Tesla achieves will be shared with SolarCity.

Summary and Risk Analysis

Given SolarCity's strong industry growth prospects, leveraged business model, economies of scale, and synergistic ties to Tesla Motors, it is no wonder that SolarCity's stock has risen more than 960% since its $8 share IPO price. One criticism of SolarCity's business model is its high upfront cost of capital. The company must continue to finance its installations at a rapid pace. As a result, the company has had to develop innovative ways to finance this growth.

In November, the company priced its first securitized solar offering. The $54.4 million offering will be backed by cash flow from a pool of solar systems and pay investors 4.8% annually, maturing in 2026. This innovative financing method opens up a new financing option for SolarCity and others in the industry. In January, the company also opened itself up to crowd fundingas another means to fund future growth. SolarCity's need for financial innovation highlights a potential risk to its business model should capital become scarce or interest rates markedly increase.

Another risk is the potential for heightened price competition which could threaten profit margins. Until recently, SolarCity and Vivent had been the only two residential solar installers that were vertically integrated: owning origination, installation, and financing. But early in February, solar leasing company Sunrun acquired three residential solar businesses. Given SolarCity's rapid market share growth, there is likely to be more industry consolidation leading to increased competition in the coming year.

Finally, an additional concern that was highlighted recently is the company's complicated accounting structure. SolarCity's fourth quarter results were delayed as a result of the accounting related to recent acquisitions and a change of overhead allocated owing to an increase in the volume of MW deployed. Their earnings results have been delayed again and are now scheduled to be reported after the close on March 18.

Best Stocks Now Analysis

Gunderson Capital Management recently initiated a position in SolarCity on 2/25/14.

The stock is a mid-capitalization stock suitable for aggressive investors given its higher risk profile. It trades at a premium valuation of almost 48X annual sales and a price-to-book of 22.4. It has annual revenue of $142 million.

1 comment:

There's a chance you're qualified for a new government sponsored solar energy rebate program.

Find out if you are qualified now!

Post a Comment